Look Back to Move Forward: Capturing IP within the One-Year Grace Period

For many emerging tech companies, pursuing patent protection often interferes with the company’s short-term objectives of increasing revenues, increasing customer adoption, and raising financing rounds. As a result, many companies choose to forego filing for patents when they first launch their product or service, thinking that if the company’s technology gets traction in the market, they can always seek patents later. However, many foreign countries limit or prohibit filing for patent protection covering technology that has already been included in a product that has been launched or disclosed to the public. The U.S. provides a “one-year grace period,” which allows companies to obtain patents on inventions that they have disclosed or included in a product release within one year of the disclosure or product release.

Because pursuing patent protection is perceived to be expensive, daunting and time consuming with no short-term tangible benefits to a company, companies often defer seeking protection until they have raised a significant amount of funding. Often times this can be well beyond a year after the company first releases a product on the marketplace. By deferring the decision to pursue patent protection, a company can miss out on getting patents on its core, foundational technology, which may serve as the company’s competitive differentiator over existing competitors in their industry. Having patents which cover that foundational technology provides a company with a technological “moat.” Consequently, by not protecting that foundational technology, a company may not be able to prevent competitors from offering features or product offerings that are very similar to their technology, thus defeating the purpose of their competitive differentiator.

Example of One-Year Grace Period Applied to Versioned Releases

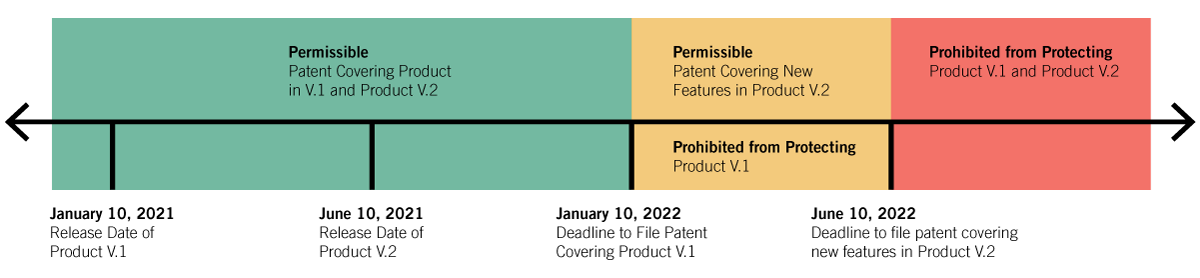

The following illustration explains the one-year grace period deadlines for filing patent applications. For instance, a company releases a first version of a product on January 10, 2021 that includes the foundational technology of the company. The company subsequently releases a second version of the product five months later (June 10, 2021), that includes additional functionality based on customer feedback and further innovations. In the illustration below, we highlight three “zones” of patent protection which are available to the company based on this fact-pattern. The green zone offers broadest protection and coverage, whereby the company can file for patent coverage in the U.S. protecting both the foundational technology and any additional functionality or improvements. The orange zone offers limited protection and coverage, whereby the company is limited to only protecting the improvements and additional functionality provided in the second release. In the orange zone, the company is not able to protect the foundational technology of the company provided in the first release. The orange zone only covers the gap between the end of the green zone (or the end of the one-year grace period from the first release) and the end of the one-year grace period of the second release. After expiration of the one-year grace period from the second release (e.g., June 10, 2022), the company is prohibited from protecting both versions of the product, which is depicted as the red zone.

Strategizing around the One-Year Grace Period

Although companies are advised to seek patent protection early to avoid a loss in value due to a failure to timely pursue patent protection, sophisticated patent counsel can help clients develop an IP strategy that is aligned with the company’s business goals and takes into account the company’s priorities and budgetary constraints, understanding that pursuing patents for the long game at the expense of risking the company’s survival can be devastating for the company.

As such, an IP strategy for an emerging tech company should take into account the amount of money raised, the date of first disclosure or launch of the technology, the timing and amount of the anticipated funding round, and the profiles of competitors (number of patents and their litigation history). This information can allow patent counsel to guide a company on how much and when to spend on patent protection.

Although it is tempting for companies to want to allocate all of their resources to functions that increase revenue, failing to properly execute an IP strategy that protects its core technology and competitive advantages can eventually result in lower revenues as competitors eat up market share and encroach in the company’s revenue stream. At a minimum, companies should ensure that they have taken adequate measures to preserve their rights to pursue patents to secure their technological moat around their core technology.

Companies that formulate an IP strategy early, and timely pursue patent protection on their foundational technology, can preserve their competitive advantage and deter competitors from encroaching in their space, all the while building their corporate resume. Also, by having a well-established IP strategy and pursuing patent protection on foundational technology, the company has the added benefit of satisfying later stage investors who pay more attention to the company’s technological moat, than early-stage investors who typically focus more on revenue, growth, commercial and product viability, and marketplace demands.

Conclusion

As an emerging company with limited resources, there is no simple solution and arguably no right answer. However, if a company is confident in its technology and believes in its long-term growth and success, pursuing patent protection on its core, foundational technology within the one-year window will pay significant dividends to the company in the long run, while at the same time providing additional short-term benefits that may not always be measurable.