Webinar Key Takeaways: Feeling Insecure About SECURE 2.0? A Discussion for Retirement Plan Sponsors

06 November 2023

SECURE 2.0 significantly changed the legal and administrative compliance landscape for retirement plans. Foley recently hosted a webinar where Leigh Riley, Kathleen Bardunias, and Kelsey O’Gorman discussed key provisions of SECURE 2.0 that will impact your 401(k) and pension plans. They provided insights and suggestions for administering your company-sponsored retirement plans in light of these new rules and related best practices. Here are some of the key takeaways from the discussion:

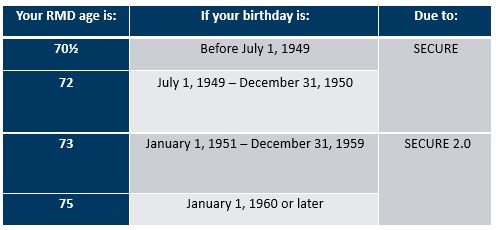

- The original SECURE Act passed in 2019 increased the required minimum distribution (RMD) age from 70.5 to 72. SECURE 2.0 again increases the RMD age to 73 or 75 for some participants. New RMD ages are set forth in the chart below.

- The original SECURE Act added a requirement that part-time employees must be permitted to make elective deferrals starting in 2024 if the employee had 500 hours of service for three consecutive years on or after January 1, 2021. SECURE 2.0 changes the requirement to 500 hours of service for only two consecutive years beginning in 2025 (with service counting for this purpose beginning January 1, 2023).

- SECURE 2.0 added several new optional plan design changes, such as student loan matching contributions and new in-service distribution options, many of which could be added to a plan as early as January 1, 2024, but we are not seeing significant interest in any of these options from plan sponsors, at least for the 2024 plan year.

- Plan amendments for SECURE 2.0 changes are generally due December 31, 2025. However, you may need to amend your plan sooner if (1) the plan terminates, (2) the plan merges into another plan, or (3) your plan vendor requires a formal amendment to implement a design change that you want to be effective before December 31, 2025.

- SECURE 2.0 further expanded the IRS’ correction program for retirement plans—the Employee Plans Compliance Resolution System (EPCRS)—including new rules about the recoupment of overpayments from plan participants, expanding the self-correction program, and establishing favorable rules for auto-enroll plans.

If you were unable to join us for this webinar, we encourage you to view the recording. If you have any questions relating to the topics covered, please contact Leigh Riley, Kathleen Bardunias, and Kelsey O’Gorman.

Author(s)

Related Insights

21 November 2024

Foley Viewpoints

Defined Benefit Pension Plans’ Annual Funding Notices Will Look Different in 2025

Most SECURE 2.0 articles focus on the changes applicable to defined contribution plans, such as 401(k) plans, and rightly so, since those plans were the most impacted by the law.

21 November 2024

Foley Viewpoints

Unlocking the Power of Equity-Based Incentive Compensation: Cash-Settled Equity Awards

This article is the sixth in our series on equity-based compensation intended to assist employers with answering a common question: What type of equity compensation award is best for our company and our employees?

21 November 2024

Manufacturing Industry Advisor

MEMA Original Equipment Suppliers Annual Conference – Outlook Panel’s Economic and Growth Forecasts for the Automotive Industry

In a year of many global market challenges that have impacted the automotive industry, the MEMA Original Equipment Suppliers Annual Conference held on November 12 and 13 in Novi, Michigan presented a detailed analysis of the current situation and future outlook for the automotive industry.