Key Issues for Suppliers to Consider in Preparing for an Impending Strike by the UAW

The United Auto Workers (UAW) Union’s contracts with General Motors, Ford, and Stellantis are set to expire on September 14, 2023. Concerns are growing among the automotive supply base about the impact of a walkout by UAW members if the parties do not reach an agreement. Automotive suppliers within the GM, Ford and/or Stellantis supply chains should consider what steps they can take now, and going forward, to mitigate the impact on their business if (and according to some, when) a UAW strike occurs.

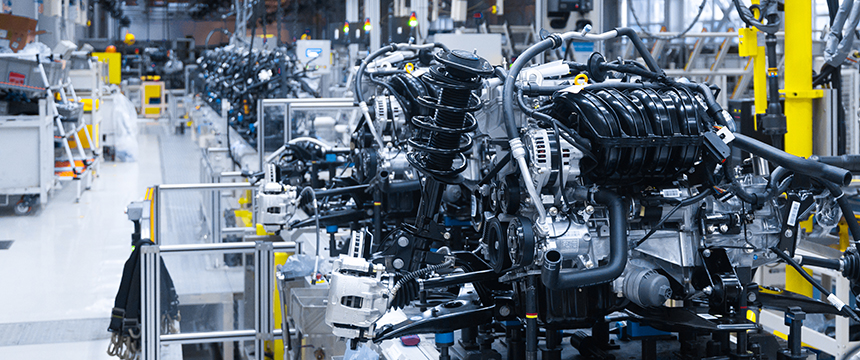

What a UAW Strike Means for Suppliers

Historically, the UAW has selected one of the big three OEMs as the target for a strike. The last strike took place against GM in 2019. The strike began on September 15, 2019, with the walkout of approximately 48,000 United Automobile Workers from some 50 plants in the United States and lasted until October 25, 2019 (40 days later). The 2019 strike was estimated to have cost GM between $3.8 and $4 billion dollars and 300,000 vehicle units in production. However, there have been rumblings that the UAW may deviate from its historical approach and engage in broad-based strikes across all three OEMs.

Regardless of the approach that the UAW ultimately takes, a strike will result in disruptions across the supply chain, including production slowdowns or shutdowns for the suppliers to the affected OEMs. Demand for parts and materials may significantly decrease or cease entirely, and cash flow to automotive suppliers may be held up for an undetermined period of time. Suppliers must immediately review their current liquidity position. Steps that should be taken to enhance liquidity include: accelerated collection of receivables (including factoring); shipment of finished goods inventory in order to convert working capital assets to cash (including inquiring whether customers will accept finished goods in excess of EDI releases); deferral of payables where appropriate and clear and early communications with lenders and customers to ensure their financial condition is known and needs are met to avoid a significant distress situation.

It is extremely important that suppliers prepare for a work stoppage not just from a liquidity/cash management standpoint but also be ready with strategies to manage their inventory and production levels and to have multi-faceted plans to deal with their workforce; both hourly and salaried. If there is a work stoppage, and it affects multiple OEM’s simultaneously, production losses will exceed 300K units by the end of September. The ripple effects into Canada and Mexico production will be nearly instantaneous and the potential exists for a negative effect beyond the big three OEMs as well.

Labor has been a major constraint of the industry since the pandemic. Within company policies and legal requirements, sending workers home must be carefully evaluated and risk managed. Length and depth of a work stoppage will dictate the specific workforce actions and accommodations to be made, however, a permanent loss in workforce availability in the current tight labor market must be considered in the context of when production resumes.

An OEM production shutdown following a strike may also accelerate obsolescence for parts that are incorporated into sunsetting vehicle platforms. Suppliers should consider and appropriately manage output to prevent an oversupply of outdated or soon-to-be outdated parts when OEM production eventually resumes.

Key Legal/Contractual Issues to Consider When Preparing for a Strike

The first step suppliers should take in preparing for a strike is to review and understand their rights (and obligations) under their contracts with potentially affected customers and sub-suppliers. Suppliers that are fortunate enough to have entered into minimum quantity or output contracts may be insulated from decreased demand for parts and materials. On the other hand, the majority of suppliers likely are under requirements contracts, and may be left with limited recourse if a customer suddenly reduces its demand to zero. Suppliers should evaluate their contractual remedies to ensure that all rights are appropriately reserved if a customer suddenly suspends production. Conversely, suppliers that are required to suspend production in response to an OEM shutdown should evaluate their agreements with sub-suppliers to determine if a contractual breach may result.

Suppliers should take particular care to distinguish between projected forecasts and firm orders. If a strike occurs, suppliers should anticipate that projected forecasts may vary considerably from firm orders. Suppliers should manage their production capacity and lead times to sub-suppliers accordingly and evaluate if and when the parties’ terms dictate when projected forecasts become firm orders.

Suppliers who have significant exposure for material and components that they will have to pay suppliers for without being able to receive payment from their customers for finished goods should look for ways to mitigate their exposure. Where permitted under the applicable contracts, suppliers should consider whether they can cancel or delay shipments from their sub-suppliers. Suppliers that are concerned customers may seek to cancel or delay an order, particularly any firm orders, may also consider requesting “adequate assurance” that the customer will take timely delivery and make timely payment for the goods, notwithstanding any strike, or else pay cash in advance for any orders before the supplier commits to ordering material and components. Under the Uniform Commercial Code (UCC), when a party to an agreement involving the sale of goods has reasonable grounds to believe its counterparty will not perform its contractual obligations, the party may make a written demand for assurance of due performance from the counterparty (UCC § 2-609). A request for adequate assurance will encourage a counterparty to disclose what its intentions are in the event of a strike and will help suppliers appropriately manage their production expectations accordingly to avoid overproduction and possible obsolescence.

Preparing for a Restart of Production

In the event that a strike results in a full or partial shutdown of production at the affected OEMs, OEMs are likely to insist on an aggressive production schedule when production resumes to make up for the downtime. This may be similar to the situation that many suppliers faced in 2020 as the automotive industry started to emerge from the shutdowns related to COVID-19. Once lockdowns were lifted and cases began to decline, many OEMs sought to immediately “flip the switch” and resume full production with little or no advance warning given to suppliers. As suppliers are aware from the last several years, production shutdowns and restarts can impose significant costs and suppliers should be thinking now about how to best mitigate material and labor costs once production resumes. Once suppliers have completed this assessment, they should communicate with their customers to make clear both the lead time and costs that will be needed for restart after a shutdown.

Special thanks to Steve Wybo from Riveron for his contributions to this article. Foley & Lardner LLP and Riveron stand ready to assist its clients as they navigate the possible effects of a UAW strike.