As we initially reported on November 4, 2021, OSHA has released its long-awaited Emergency Temporary Standard (ETS) covering private employers with 100 or more employees. While we have seen court challenges and indeed the U.S. Court of Appeals for the Fifth Circuit (covering Texas, Louisiana and Mississippi) has temporarily enjoined the ETS, employers should not rely on that as a ticket to do nothing. Time is running short and employers should proceed with the assumption that the deadlines are real.

As covered employers begin to navigate these uncharted waters, we are providing a step-by-step guide to help you comply with the new ETS. Here are a few suggestions:

Step 1: Consider if the ETS Applies

- Keep in mind that the ETS only applies to private employers with 100 or more employees.

- To determine if the employer meets the threshold, employers must consider: (1) all U.S. locations, (2) include all part-time employees, but not independent contractors; (3) include all locations of corporate entity with multiple locations; (4) franchises are treated separately; (5) integrated companies that handle safety matters as one company are considered a single employer; (6) temporary employees and staffed employees not counted; and (7) for multi-employer sites such as construction sites – each employer counts only its own employees.

- The ETS does not apply to federal contractors and healthcare covered entities which are subject to their own mandates. With respect to the latter group, the Centers for Medicare & Medicaid Services (CMS) provided a release regarding its Rule – with its requirements, and included a link to an FAQ. Healthcare providers should know that the Rule was effective last week.

Step 2: Consider Whether to Mandate Vaccinations or Offer the Testing Alternative

- A covered employer must decide if it wishes to mandate vaccinations at one or more of their locations.

- There may be risks and benefits to consider for both the mandatory vaccination and testing alternative. For example, state law may dictate that covered employers pay the costs of testing if it offers that alternative. Further, if an employer offers the testing alternative and an employee requests (and is granted) an accommodation based on medical or religious reasons, the employer may have to pay for testing costs.

- As covered employers begin to consider their options, Foley’s Labor & Employment team is prepared to assist in decision-making as well as adopting conforming OSHA-compliant policies.

Step 3: Consider if There are Exempt or Excluded Employees

- The ETS covers approximately all employees, except those employees who work remotely from their homes, exclusively by themselves, or exclusively outdoors.

- The ETS also states that employers may implement different policies applicable to specific portions of the workforce. For example, an employer may have a mandatory vaccination policy for employees who interact with customers but offer the testing alternative for employees who intermittently work remotely and/or work for headquarters and rarely interact with customers.

Step 4: Implement a Policy (or Policies) / Communicate to Employees (By December 5, 2021)

- A covered employer must comply with the ETS by December 5, 2021. Foley has prepared template policies for both the mandatory and testing alternatives and can assist you with tailoring your own specific policy.

- As part of the ETS, covered employers must also provide employees with specific information related to COVID-19 testing, the procedure for gathering acceptable vaccination records and determining vaccination status, the time, pay and leave employees are entitled to, the procedures for notifying the employer of a positive COVID-19 test, and the criminal penalties associated with employees knowingly providing false information and prohibitions on discrimination.

Step 5: Gather Acceptable Proof of Vaccination Records, Compile an Employee Roster and Implement a Recordkeeping System (By December 5, 2021)

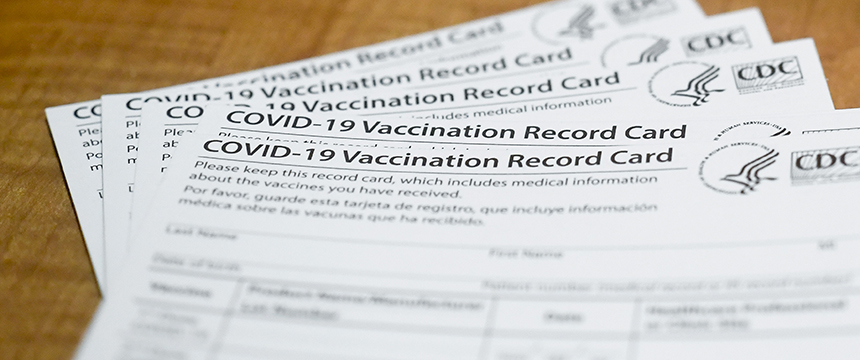

- A covered employer must collect acceptable proof of vaccination records from employees (e.g., vaccination cards, medical paperwork, or an attestation). The proof of vaccination may not be submitted verbally.

- Based on the provided information, a covered employer must compile and retain an employee roster that lists each employee and their respective vaccination status (whether they are fully vaccinated, partially vaccinated, not fully vaccinated because of a medical or religious accommodation, or not fully vaccinated because they have not provided acceptable proof of vaccination status).

- A covered employer must implement a recordkeeping system and maintain these records as they would other confidential medical documents for the duration of the ETS.

Step 6: Analyze Each Medical and Religious Accommodation Request

- A covered employer must analyze each medical and religious accommodation request in accordance with federal, state and local laws.

- The ETS states that employers may submit employees to weekly testing as an accommodation (but must pay the costs associated with the testing if the employee if the testing is offered as an accommodation).

- The ETS also states that other accommodations must be offered if an employee’s sincerely held religious belief does not allow them to submit for testing.

Given these many new requirements, employers should contact counsel and make sure they are prepared to implement the requirements of the ETS (in the event that the ETS is upheld by the courts) to avoid potential future penalties.