Foley attorneys Darin Lowder and John Dunlap recently hosted a Foley Energy Webinar with panelists Ben Cooper from KeyBank, Eric Barr from U.S. Bancorp, and Jared Donald from Amp Solar to discuss recent trends in financing community solar projects. Highlights of the webinar are listed below, and the full webinar is available here.

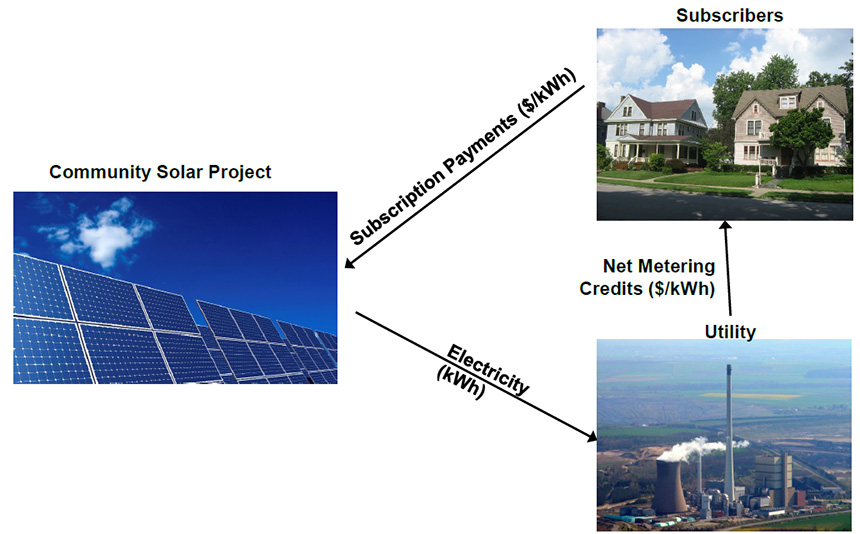

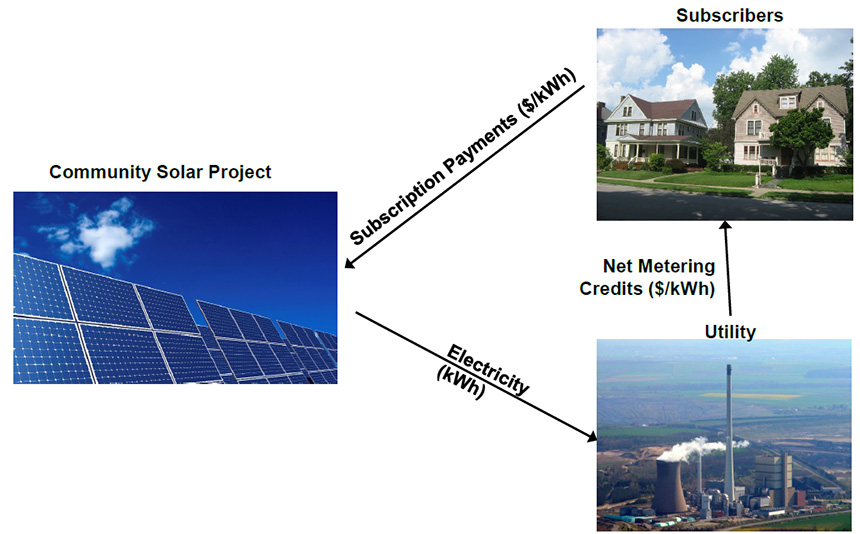

The webinar provided a survey and overview of the community solar projects market in the United States. Community solar projects deliver electricity to a local utility, which in turn allocates net metering or bill credits to retail energy customers (referred to as “subscribers”) in accordance with individual subscription agreements entered into between the subscribers and the project owner. The subscribers pay the project owner, rather than the utility, for their allocated share of the credits.

Figure 1: Overview of Community Solar Transaction Structure

Community solar programs are developed by states and utilities with a focus on community benefits, which may include the redevelopment of brownfield sites and incentives to include low to moderate income (“LMI”) subscribers in the programs to make the benefits more widely accessible.

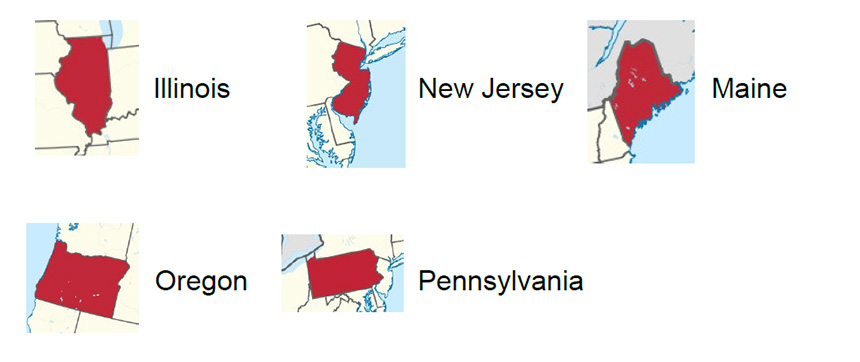

Three established, key programs discussed in the webinar include the Massachusetts SMART program, the Minnesota program and the New York program (including New York’s VDER scheme for valuing net metering credits). Additionally, our firm continues to monitor newer, emerging programs in a variety of states, including those shown in Figure 2, which have implemented or proposed programs.

Figure 2: States Implementing or Proposing New Community Solar Programs in 2019

The panel discussed financing considerations applicable to both debt and tax equity, which sponsors and financing parties should address, including:

- Confirming aspects of the project portfolios themselves, including (a) whether the portfolios will be “closed” (i.e., the projects included in the financing are set at the time of closing) or “open” (i.e., the projects included in the financing are not set at the time of closing and the financing is structured in a way that permits the addition of additional or different projects that meet certain criteria over time) and (b) the amount of variety within the portfolio (e.g., portfolios spanning multiple states and community solar programs are more complicated to design and structure, and may be more difficult for tax equity investors and lenders to underwrite)

- Level of management required for a large number of subscribers over an extended period of time, which can increase developer cost and may require third party management to address subscriber retention concerns

- Focus on subscriber creditworthiness, including the interplay with LMI subscribers and commercial/municipal offtakers that are not rated

- Program eligibility under specific programs, since many community solar programs are capped in size, and projects may not be considered financeable until they are awarded participation in the program

- Inconsistency in the timing of payments, which can make lenders hesitant to make construction loans based on those revenue streams

Please contact Darin Lowder, John Dunlap, or other attorneys on the Energy Industry Team, with questions or to learn more about these rapidly growing programs.