David Kantaros serves as Co-Chair for Artificial Intelligence within our Innovative Technology sector and is a member of the Private Equity & Venture Capital and Transactional & Securities Practices. He represents venture capital and private equity funds as well as publicly and privately held corporations in the emerging technology and life science industries.

David’s experience includes: representing private equity funds, family offices, and public and private companies in mergers and acquisitions, joint-ventures, public offerings, and control investments; advising venture capital firms, strategic investors, and high net worth individuals and investment groups in private placement activities, including preferred stock and secured and convertible debt financing in technology and life science companies; counseling high-tech, as well as biotechnology, pharmaceutical and medical device companies as to corporate structure, technology protection and transactional matters; advising investors, corporate boards and public and private companies on complex domestic and cross-border transactions including corporate migrations, re-incorporations and joint venture arrangements; and structuring and negotiating technology license agreements, including master license agreements, OEM agreements, Beta test agreements, shrinkwrap agreements and strategic relationships involving the sharing of technology.

Representative Experience

- Represented Torc Robotics, self-driving vehicle technology company and an independent subsidiary of Daimler Truck AG, in its acquisition of Algolux Inc. (2023).

- Represented Patient Funding Alternatives in its sale to affiliates of Leonard Green & Partners (2022).

- Represented SymphonyAI, a leader in high-value enterprise AI SaaS for strategic industries, in its acquisition of financial crime detection leader NetReveal from BAE Systems (2022).

- Represented Digital Guardian, a SaaS provider of data loss prevention (DLP) solutions, in its sale to HelpSystems (2021).

- Represented Panalgo, a health care data analytics company, in its sale to Managed Markets Insights & Technology (2021).

- Represented 829 Studios, a digital marketing services company, in a control investment by CVIC partners (2021).

- Represented Mayo Clinic in a strategic control investment with Kaiser Permanente in Medically Home, a technology-enabled services company providing platforms for in-home care (2021).

- Served as co-counsel for AST Space Mobile, a developer of space-based cellular broadband network to be accessible by smartphones, in its SPAC IPO with an equity value of US$1.8bn (2021).

- Represented Symphony AI in its acquisition of TeraRecon, an AI medical imaging company (2020).

- Represented Marathon Venture Capital in a Series A investment in Velos Rotors, Inc., an unmanned aerial vehicle (UAV) helicopter company (2023).

- Represented Alpine Space Ventures as lead investor in a Series A financing in Morpheus Space, Inc., a leading satellite mobility provider (July 2022).

- Represented Braemar Energy Ventures in its preferred stock financing in Renew Financial Holdings, a company that provides innovative financing solutions for building contractors (2022).

- Represented ConcertAI, an oncology-focused real-world data and SaaS startup, in a US$150m Series C financing from Sixth Street Partners with a US$1.9bn valuation (2022).

- Represented Teikametrics, the leading optimization platform for sellers on Amazon and Walmart, in a US$40m Series B financing led by Intel (2021).

- Represented Utilidata, an industry leading grid-edge software company, in a US$26m Series D financing from Moore Strategic Ventures (MSV), Microsoft Climate Innovation Fund and NVIDIA (2022).

- Represented AIMI, and AI powered music platform, in a US$20m Series B financing from Great Mountain Partners and Founders Fund (November 2021).

- Represented Stage 1 Ventures in a US$52m preferred stock investment in Witricity, a wireless charging company, with co-investments from Air Waves Wireless Electricity and Mitsubishi Corporation (Americas) (2021).

- Represented AST&Science in a US$128m Series B financing from Rakuten, Vodafone, American Tower, and Samsung Next (2020).

Awards and Recognition

- Selected for inclusion in Massachusetts Super Lawyers–Rising Stars® editions for his work in securities and corporate finance (2005, 2006)

- Selected by his peers for inclusion in The Best Lawyers in America© in the field of Venture Capital Law (2012-Present)

Thought Leadership

David has lectured on issues relating to representation of venture capital funds and portfolio companies in private equity financings, representing buyers and sellers in mergers and acquisitions and the structuring of strategic relationships and joint ventures around technology developments.

Affiliations

- Member, American Bar Association

- Member, Massachusetts Bar Association

AI and Greece: An Emerging Innovation Destination

Hellenic Innovation Network of New York: Innovation & Impact

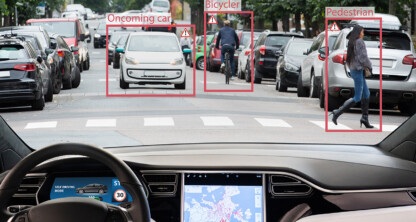

Navigating the Road Ahead: How AI and Vehicle Automation are Transforming the Transportation Industry

The Fast Follower’s Guide to Recent AI Law

ScaleUp Labs Demo Day: Showcasing Innovation and Vision