Fernando Camarena Cardona

Partner

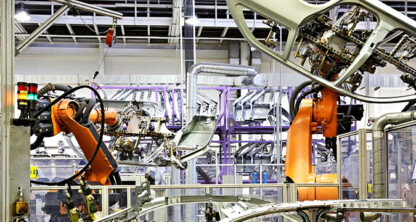

Fernando Camarena is a senior business and legal advisor on international and domestic tax issues in Mexico, providing both tax counseling and assistance with litigation. He is a partner in the Taxation, Employee Benefits and Executive Compensation, and Transactions Practices. He represents medium-sized companies to Fortune 500, FTSE 100, and other global and brand name corporations in the energy, manufacturing, nutritional supplement, insurance, and other industries.

Fernando is frequently sought after by clients for his broad understanding of tax laws and systems around the world. He is described by clients in the Chambers & Partners Latin American Guide as having deep financial knowledge that “allows him to understand not only the tax implications but also the business with which he is dealing.” With referrals from clients and major law firms around the world, he is passionate about clients’ primary goal of conducting business in Mexico as tax efficiently as possible.

Fernando has extensive experience in M&A and corporate transactions. He has a deep understanding of the corporate vision, as well as the technical transaction specifics for U.S. and foreign corporations, such as the permanent establishment issue that arises in joint ventures, especially in the energy industry, and the country-specific treaties on double taxation. His experience also encompasses insurance regulatory and government contracts matters.

U.S. and European companies are confident when they hire Fernando that he has superior international tax knowledge, and that he understands the entire business picture and structure under which they are operating. American clients appreciate that he knows the reporting that must be done in the U.S. – FIN 48, which they must file when they have an income tax issue abroad.

Awards and Recognition

- Recognized, The Best Lawyers in Mexico (Steven Naifeh & Gregory White Smith eds., Woodward/White Inc.)

- Corporate Law (2015-2025)

- Mergers and Acquisitions Law (2015-2025)

- Amparo Law (2020 – 2025)

- Administrative Law (2020 – 2025)

- Real Estate Law (2023-2025)

- Tax Law (2023-2025)

- Project Finance and Development (2023-2025)

- Leisure and Licensing Law (2025)

- Recognized, Chambers Latin America: Latin America’s Leading Lawyers for Business

- Tax (Mexico) (2011-2024)

- Recognized, Chambers Global:

- Tax (Mexico) (2011-2023)

Affiliations

- Member, Illustrious and National Mexican Attorney’s College

- Member, Mexican Attorney’s Bar

- Member, Tax Commission of the Mexican Attorney’s Bar

- Member, Legal Precedents Commission of the International Fiscal Association (IFA)

- Member, International Tax Commission of the Mexican Accounting Institute

Languages

- English

- Spanish

Foley Attorneys Featured for International Trade, Manufacturing in Mexico Webinar

2025 In-House Connect Supply Chain & Trade Law CLE Summit

Mexican Government Announces Tax Incentives in Support of Nearshoring

Incoming Perfect Storm?: The Shifting Regulatory Landscape for Automotive Manufacturers in Mexico

Chinese Mobility in the USMCA Region: A Choking Process that will Upend the U.S. and Mexican Automotive Industries