Tariff & International Trade Resource Page

The Trump administration has implemented a wide array of new tariffs, including special tariffs aimed at individual countries (Canada, Mexico, and China); tariffs aimed at individual products (aluminum, steel, and automotive); new 10% global tariffs; and new reciprocal tariffs that are as high as 49%. With the United States moving into a high-tariff, high-penalty environment, importers have never faced higher risks of Customs penalties or detentions.

To help importers cope with these changes, the Foley International Trade Team, in cooperation with the Supply Chain Team, has put together focused, practical resources to help companies manage the international trade turbulence. This Tariff & International Trade Resource page is designed to provide the resources and tools that importers need to understand, risk plan, and manage tariff and international trade risks as well as compliance risks arising from the aggressive enforcement of U.S. law extraterritorially.

Search Tariff & International Trade Resource Page

What Every Multinational Company Needs to Know About … Criminal Enforcement of Trade, Import, and Tariff Rules: A Growing Risk for Businesses

What Every Multinational Company Should Know About … The Current Trump Tariff Proposals

What Every Multinational Company (Doing Business in Mexico) Should Know About … Mitigating Risks From ATA Scrutiny in a New Enforcement Regime

What Every Multinational Company Should Know About … The Rising Risk of Customs False Claims Act Actions in the Trump Administration

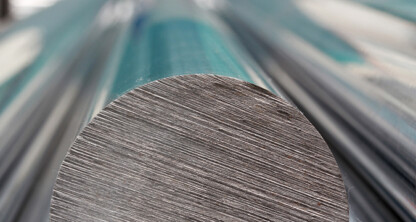

What Every Multinational Company Should Know About … The New Steel and Aluminum Tariffs (Part II)

What Every Multinational Company Should Know About … The New Steel and Aluminum Tariffs (Part I)

Business Impacts of Trump’s Executive Order Pausing FCPA Enforcement