Inflation Woes: Four Key Ways for Companies to Address Inflation in the Supply Chain

Supply Chain Disruption Series: Article 1

The U.S. economy is grappling with the highest inflation in decades, with extensive inflation in the supply chain affecting companies worldwide. Supply chain disruptions undoubtedly have contributed to rising inflation, as extensive delays and skyrocketing costs continue to plague the industry.

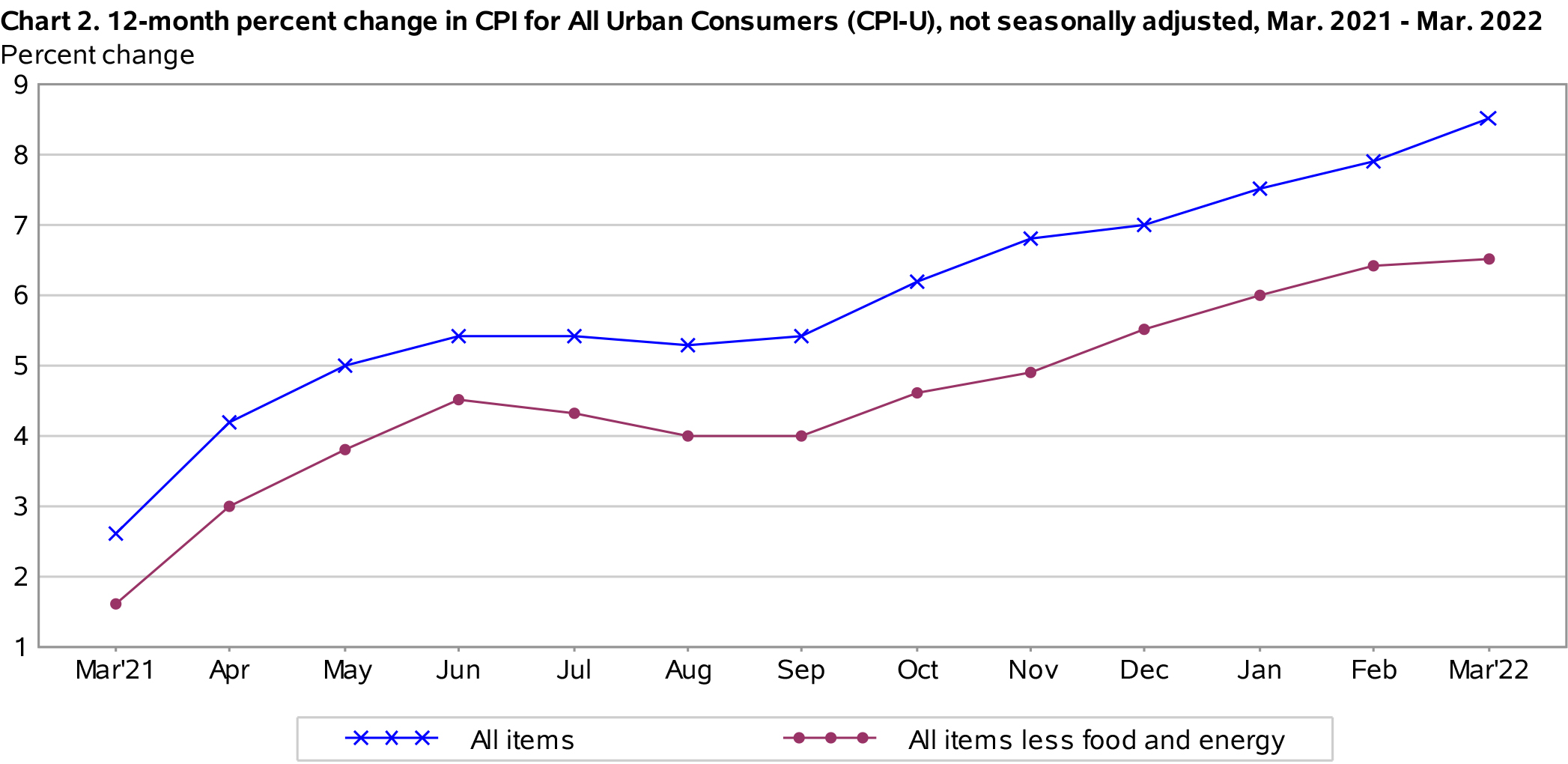

In March 2022, the consumer-price index (or CPI) — a measure of the prices consumers pay for products — rose at an annual rate of 8.5%, which is the highest increase in 47 years.1 Meanwhile, the producer-price index (or PPI) — a measure of inflation meant to gauge the impact on suppliers — similarly rose significantly at an annual rate of 11.2%.2 Finally, the employer cost index (or ECI) demonstrates that, from March 2021 to March 2022, total compensation rose 4.5%, wages and salaries rose 4.7%, and benefit costs rose 4.1%.3

Because inflation increases the prices of goods or services, negotiations about who bears that risk in business partner relationships and the consequences of that risk allocation will have significantly greater financial impacts than we have seen in recent memory. As a result, ensuring your business teams are well versed on the impacts of and means of mitigating inflation in new contracts has a direct impact on your bottom line.

In this article, we provide ways for companies in the supply chain to address high inflation and alleviate associated pressures, including (1) how to revisit and use existing agreement provisions to address inflation risk, (2) approaches to negotiating new agreements and amendments to existing agreements, (3) approaches to limit inflationary exposure, and (4) strategies for cost reduction.

Figure 1:

Percent Change in CPI March 2021 versus March 2022

Bureau of Labor Statistics, U.S. Department of Labor, Consumer Price Index – March 2022, issued April 12, 2022

Four Key Ways to Mitigate the Effects of Increasing Inflation in the Supply Chain

1. Revisit and Use Provisions in Existing Agreements

Companies faced with rising costs must review their supply agreements to determine if they already contain mechanisms the company can use to address inflation. On the buy side, companies should look in their agreements for terms relating to fixed prices. On the sell side, companies should investigate ways to pass increased costs on to customers. Most supply contracts contain a variety of provisions that may assist in combatting inflationary pressures.

(a) Pricing Provisions

From a seller’s perspective, a contract may include index-based price escalation provisions, which tie contract prices to one or more indices. The underlying indices may be (i) broad economic indices such as the PPI or “market basket” indices tied to all items and all urban consumers, (ii) targeted indices such as ECI for a specific location, or (iii) tied to the cost of a specific commodity used in the underlying product. Contracts will sometimes incorporate several commodity indices based on the percentage those commodities are used in the product that is the subject of the agreement, in order to accurately reflect the costs associated with producing the good.

Allocations under these pricing provisions vary depending on negotiation power. They could put all of the risk on one party, share the risk equally, or share the risk according to particular percentages. The latter two options represent ways to avoid a “win/lose” approach.

Sellers will want to see whether their agreements allow for periodic negotiations for updated prices and take advantage of those opportunities. A buyer, meanwhile, may look for provisions that allow it the flexibility to limit the quantities ordered, enabling it to reduce costs as necessary or to seek a more cost efficient alternative. A buyer also will want to determine if the contract prohibits the seller from changing prices.

Regardless of the existing provisions, the real impact of inflation is likely to trigger commercial discussions to address rising costs; this is true both for hard goods supply agreements and indirect services agreements with longer terms such as outsourcing and managed services relationships.

(b) Force Majeure as a Mechanism to Adjust Price?

Outside of pricing provisions such as the above, however, a party may look to other contract provisions, such as force majeure, to see if its performance under the contract could be excused; increased costs alone are not enough to constitute a force majeure event. In order for a force majeure to arguably apply, the increase in costs must be caused by an event that itself is a qualifying force majeure event under the terms of the applicable contract (which may include events like a labor strike or pandemic).

Force majeure provisions are intended to excuse performance under a contract but not to act as a pricing adjustment mechanism. However, force majeure and its extra-contractual cousin, commercial impracticability, can be used as tools to bring the parties to the negotiating table where events beyond either party’s reasonable control are impacting the ability to produce and deliver products.

2. Negotiate Amendments to Existing Agreements

To the extent sellers have fixed-price contracts with their customers, sellers should consider negotiating with such customers to adjust these contracts in order to keep the prices they charge their customers in line with their input costs. When entering these discussions, companies that wish to implement a price adjustment, or eliminate fixed pricing entirely, should consider meaningful ways to incentivize their customers to agree to such changes. Would the customer be willing to agree to a price adjustment in order extend the agreement or adjust the quantity? Any items that maintain the relationship between the parties while also allocating cost increases in an equitable way should be considered.

Conversely, buyers faced with price-increase requests should carefully consider their options:

- First, a customer receiving a price-adjustment request should confirm the request is actually tied to inflation and not just an attempt by a supplier to increase its bottom line. Seek detailed calculations supporting the price adjustments, and require suppliers to demonstrate how much their costs have increased above expectations.

- Second, customers should consider what items they would like to request in return for accepting a given price-adjustment request, such as whether they would like to adjust their quantity or timing of delivery.

- Third, a customer faced with a price increase request should consider whether the request should include the opportunity for the customer to obtain pricedowns in the future, in the event there are changes in the pricing environment.

3. Pricing Tied to Indexing and Other Ways to Limit Future Inflationary Exposure when Drafting New Agreements

When drafting new agreements, companies should consider how best to mitigate the effects of inflation.

For nearly 40 years, we have enjoyed relatively low and steady levels of inflation, which explains why existing agreements may not adequately address the allocation of significant and unexpected economic change.

Many of those at the upper echelons of leadership today have never dealt with a high inflationary environment. To put it in perspective, the CEO of Walmart, the No. 1 company on the Fortune 500 list for 2021, was 19 years old when inflation was last a newsworthy topic.

In the future, however, we expect far fewer agreements to have long-term fixed prices, as sellers negotiating agreements will want to incorporate a variety of strategies that allow for pricing flexibility and avoid longstanding, fixed prices. One such strategy is tying prices to an index. As discussed above, this could be a general index such as the CPI or PPI or be much more specific depending on the item sold. There are numerous indices for various products and commodities that parties may use to reflect accurately the costs of producing the goods that are the subject of their agreement. Parties may consider incorporating a mechanism for revisiting these provisions, especially in the event that inflation slows. Caps on inflation risk also may be incorporated as a backstop.

If not tying prices to an index, selling parties will want to shorten the term of their agreements or require the parties to renegotiate prices at set points throughout the duration of their agreements. Alternatively, parties may consider price increases of a certain percentage that are automatically implemented periodically. The seller may even want to leave the pricing open and establish pricing at the time the order is placed.

On the other hand, customers will want to incorporate provisions that cause the supplier to bear the inflationary risk. Principally, this means locking in prices for as long of a period as the seller will agree to and ensuring prices are fixed upon the issuance of purchase orders.

If and when sellers push back on extended fixed-pricing provisions, there are a variety of methods parties may use to meet in the middle:

- Pricing arrangements that are tied to one or more indices may be capped to a certain percentage, ensuring the customer will know its upward exposure.

- Include thresholds of index movement such that the price remains static unless and until the percentage threshold is exceeded.

- Allocate increased cost exposure so a certain percentage range of index movement is allocated to one party and then the next percentage range is allocated to the other party. Parties then may share any exposure above those ranges.

- Additionally, index-based pricing can be clarified to include both upward and downward movement, ensuring that customers, while risking inflationary costs, may also receive the benefits of deflationary environments.

4. Think Strategically to Reduce Costs

Aside from considering purely contractual methods to combat inflation, companies should think strategically about ways to reduce costs more efficiently.

- Streamlining. In order to pursue this strategy, companies need to determine which areas are driving increased spending and consider ways those areas may be managed differently. For example, companies may consider whether there are different inputs that can be used to lower costs or processes that may be streamlined. Companies can review their inventory management, labor inputs, and other areas to determine where cost cutting may be an option without sacrificing product or service quality. This streamlining might include ending product lines with lower levels of profitability.

- Technology & Innovation. In addition, with labor constituting such a high percentage of the cost increases companies are experiencing, a company may want to double down on technology and innovation that reduces headcount. Or, as prices rise, a company may pursue other pricing models. For example, a heavy equipment manufacturer may opt for a pay-per-use model in lieu of the traditional sale model.

- Diversification of the Supply Chain. Another method companies may use is diversifying their supply chains, ensuring they provide the flexibility and sustainability needed to weather turbulent periods. Though adding links to supply chains will not lower costs in the near term, it can help ensure a business continues to function smoothly even in the event of price shocks, material shortages, or other disruptions.

The stressors driving inflation are unlikely to be relieved any time soon. Companies should use every resource available to leverage their current contracts and negotiate new terms to address inflation’s serious repercussions on their bottom line.

Subscribe to the Supply Chain Disruption Series

To help you navigate these uncharted territories in supply chain, we invite you to subscribe to Foley’s Supply Chain Disruption series by clicking here.

1 How High Is Inflation and What Causes It? What to Know, Wall Street Journal (April 12, 2022).

2 Supplier Prices Rose Sharply in March, Keeping Upward Pressure on U.S. Inflation, Wall Street Journal (April 13, 2022).

3 Employment Cost Index – March 2022, U.S. Department of Labor, Bureau of Labor Statistics (April 29, 2022).