11 Key Strategies to Protect Your Company’s Supply Chain and Mitigate Risks Against Financially Distressed Customers and Suppliers

As we pass the midpoint of 2022 and the world expresses a collective sigh of relief that the worst of the COVID-19 pandemic seems to be behind us, a perfect storm of extraordinary factors is creating conditions for financial distress throughout many supply chains. In short, there is a substantial risk that companies obligated to pay you for goods or services or to supply goods or services to you might become unable to do so.

In this article, we provide you with a toolkit to mitigate your supply chain risks in the face of this expected economic turmoil.

Note: Because these situations are fluid, complex, risky, and involve various potential legal risks in their analysis and implementation, it is important that you engage with bankruptcy/creditors’ rights counsel early in addressing them.

Understanding the Impact of a Possible Bankruptcy

To prepare for insolvency-related non-performance by a customer or supplier, it is critical to know the effects of a possible bankruptcy on the obligations owed to you under your contracts or other arrangements with the customer or supplier that would be a “Debtor” in bankruptcy.

What Type of Bankruptcy: Chapter 11 bankruptcies allow a Debtor’s management to stay in control, continue operating and providing goods and services, restructure debts, sell some or all company assets, and confirm a reorganization plan. In contrast, in Chapter 7 bankruptcy cases the Debtor’s management is removed and replaced by a bankruptcy trustee, who is responsible for liquidating the Debtor’s assets and generally stops operating the business.

Section 362 Automatic Stay: Once a bankruptcy is filed, the automatic stay arises and acts as an injunction against any efforts, including continuation of pending litigation, to collect on any prepetition claim, debt, or other obligation owed by the Debtor, any action to possess or control the Debtor’s property (e.g., foreclosure, perfection of liens subject to limited exceptions, seizure of the Debtor’s assets), and most unilateral attempts to terminate contracts or execute setoffs. Unless court approval is obtained, acts taken in violation of the automatic stay are void or voidable. Creditors that violate the automatic stay can be liable to the Debtor for damages. Due to the automatic stay, many of your rights as a creditor or contract party will be stronger before a bankruptcy is filed, rather than after.

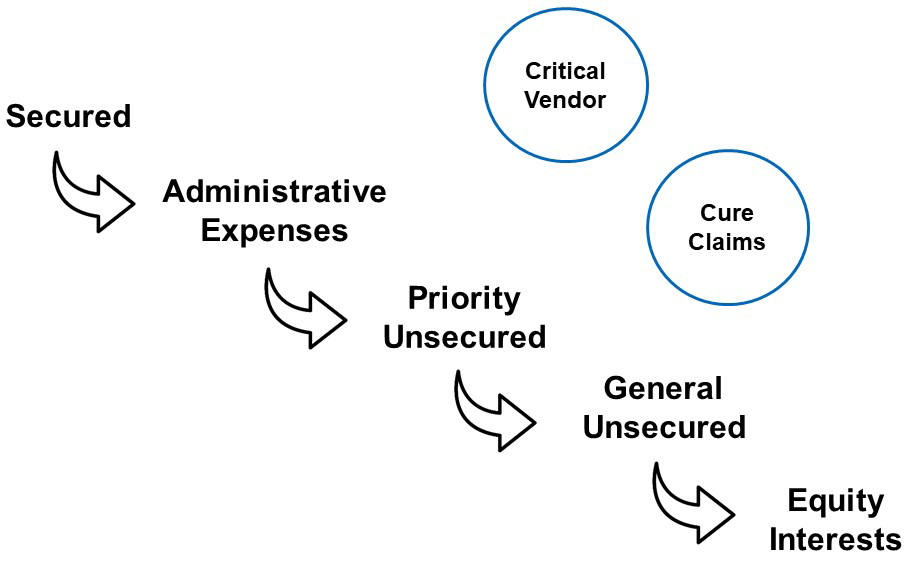

Priority Payment Scheme: Under the Bankruptcy Code there is a priority payment scheme, which identifies which claims are paid first and requires that the higher level claim must be paid in full prior to any lower level claim receiving a payment. Think of a waterfall: At the top of the waterfall are secured claims (amounts secured by security interests, liens, or mortgages, such as most bank loans), followed by administrative priority claims (including expenses incurred by the Debtor during the bankruptcy such as its professional fees or amounts for postpetition goods or services), then priority claims (including certain tax claims), followed by general unsecured claims (including most ordinary trade debts), and finally equity interests (see chart below.)

There are a few exceptions to this scheme, including: (a) claims for goods actually received by the Debtor within 20 days prior to the bankruptcy, referred to as “503(b)(9) Claims”1 that are given administrative priority treatment; (b) prepetition amounts due under assumed contracts and leases that are treated as cure claims which are entitled to be paid in full in cash; and (c) prepetition general unsecured claims that the Debtor obtains Court approval to pay, for instance pursuant to an order authorizing the Debtor to pay vendors critical to its continuing operations.

Executory Contracts:2 As of a bankruptcy filing, a Debtor obtains significant leverage and additional rights regarding contracts with you pursuant to the Bankruptcy Code. Notwithstanding anti-assignment clauses, a bankrupt Debtor can assume (i.e., agree to perform), and then assign to a third party (subject to demonstrating adequate assurance of future performance), or reject (refuse to perform) any executory contract3 (subject to limitations for certain personal service, IP and license, and loan or financial commitment agreements). A Debtor must assume4 or reject5 executory contracts no later than confirmation of the Chapter 11 plan.

Preference and Fraudulent Transfer Risks: To complicate matters, payments, liens, or obligations made in your favor while the Debtor was insolvent prior to a bankruptcy can potentially be recovered or “avoided” (although it is generally better to receive such a payment and fight about possible avoidance of it with a Debtor or bankruptcy trustee rather than not be paid at all).6

Given the foregoing and possible negative aspects of contract rejection (i.e., non-payment/non-performance, little recovery of damages, potential assignment to unknown third parties) and possible positives (cure payment of any outstanding arrearages required for assumption and assignment), you should carefully evaluate with bankruptcy counsel the contract and claim strategy that is optimal for you in dealing with an insolvent customer or supplier and ensure the proper legal requirements are met to enforce your rights.

Key Strategies for Addressing Financial Distress in the Supply Chain

1. Monitor Your Supply Chain For Warning Signs of Weakness

It is a good practice to establish teams and training in advance with personnel from the engineering, purchasing, sales, finance, and legal teams to routinely monitor for, and handle, possible troubled company situations. Using that team to implement an ongoing practice of due diligence into your customers and suppliers’ financial health can provide you with useful tactical intelligence and the ability to execute quickly in advance of a problem becoming a crisis.

This includes conducting a pre-contract due diligence analysis on customer/vendor quality and financial performance and regular evaluation of the customers and companies in your supply chain for warning signs, including:

- Requests for accommodations such as changes to credit terms, increases in credit limits, or accelerated payments

- Use of factoring arrangements to bootstrap liquidity

- Deteriorated working capital ratios and inventory issues

- Slow payments

- Delay or renegotiation of scheduled dividends, bond payments, or loan payments

- Fully drawn lines of credit

- Costly and/or troubled launches of new products

- Impending maturity dates or big-ticket litigation claims (common bankruptcy triggers)

- Quality and delivery deficiencies

- Loss of customers

- Changes in key management

- Retention of financial advisors or insolvency lawyers

- Fraud or securities investigations or restatements of securities disclosures

2. Evaluate and Update Your Contracts and Purchase Order Terms

The strength and terms of your contracts will affect your rights and remedies both before and during any bankruptcy. Some key terms to review include, but are not limited to:

- Credit and payment provisions (how quickly you have the ability to change payment terms, reduce credit limits, or demand additional security)

- Termination (whether there is a termination for convenience provision and what are the notice and cure periods to terminate for cause)

- Term of Contract (considerations on whether to extend a contract or limit term)

- Financial information and other audit rights (right to obtain information or exercise audit rights)

- Offset and recoupment rights (including any contractual limitations on such rights)

Moreover, where your counterparty is a member of a corporate group of affiliates you should consider whether the counterparty has its own material assets or whether such counterparty is more of a contracting “shell” for other companies in that corporate group. The latter is exponentially more risky in the event of insolvency.

You also should update your contracts and terms to include favorable terms to defend against insolvent customer and supplier situations in advance, including terms that give you financial and operational transparency, lien rights, and stronger termination and setoff rights.

3. Evaluate Resourcing Options and Develop a Resourcing Plan

Customers to a troubled supplier should consider whether parts can be sourced from multiple suppliers to decrease the risk of sole suppliers if possible. In addition, customers of a distressed supplier should immediately evaluate resourcing options (cost/benefit and risks of resourcing) and develop a back-up plan and timeline, including a process and decision tree chart, for supply resourcing to enable speedy and decisive action. Building up a parts bank, to the extent possible under your contracts, can also help create a timing cushion to add safety to your resourcing efforts.

4. Perfect Liens to Provide Leverage and a Source of Recovery

You may have rights under your contracts or applicable law to obtain liens and security interests for goods sold or services performed to a financially distressed customer. Examples of these liens include contract rights to Article 9 security interests under the applicable state Uniform Commercial Code (UCC), mechanic’s and materialman’s liens, mineral liens, tooling or molder’s liens, storage liens, and warehouseman’s liens. Your contract process should be reviewed for adding these types of rights and following through on meeting any applicable state law requirements, including any timing and notice requirements. For previously filed or otherwise perfected liens and security interests, you may want to confirm that they remain in effect against the appropriate counterparty.

5. Understand the Rights of Setoff and Recoupment

Setoff and recoupment are useful tools that allow parties to withhold or offset such claims against each another, which can protect you against paying any amounts to a party that owes you money. However, there are key differences, especially if a bankruptcy is filed, as it applies to the transactions and parties involved in the exercise of such rights.

Setoff: Unless your contract limits the exercise of your setoff rights, setoff is not limited to one transaction or contract and can be useful to offset various transactions and contracts between the parties to arrive at a net amount. As a sometimes useful tactic, you can try to apply setoff to claims owed by or to related third parties pre-bankruptcy if your contract allows these sorts of “triangular” setoffs.7

Recoupment: This is an equitable remedy that is available when amounts due to and from the Debtor arise from the “same transaction” with the counterparty. This “same transaction” requirement is construed narrowly by the courts to mean that the claims must arise from the “same contract” to be recouped.8

Once a bankruptcy petition is filed, there are key differences between the treatment of setoff and recoupment rights. The exercise of setoff rights requires relief from the automatic stay by court order and is limited to netting prepetition debts against prepetition obligations or postpetition debts against postpetition obligations. In contrast, recoupment is not subject to the automatic stay, possible bankruptcy setoff pitfalls of preference avoidance, or the prohibition against recouping prepetition and postpetition claims. However, in exercising any recoupment right a creditor must still be mindful of the automatic stay and should, in an abundance of caution, consider seeking court approval.

6. Issue a Demand for Adequate Assurance of Future Performance

When reasonable grounds for insecurity exist concerning a contracting party’s willingness or ability to perform a future obligation under a contract for goods, the other party can issue a demand for adequate assurance of performance under section 2-609 of the UCC.

Reasonable grounds for insecurity depend upon the circumstances and may include credit insecurity, late payments, and stated illiquidity (such as news reports showing the counterparty’s financial condition threatens their future performance).

The party receiving the demand must provide assurances concerning its ability to perform future obligations, or if they do not provide them, the demanding party can treat the contract as repudiated or breached.

Section 2-609 provides useful rights and leverage to: (a) suspend or modify performance (e.g., change credit terms)9 if appropriate assurances are not provided; (b) negotiate major concerns and issues before an actual breach occurs; and (c) shore up a position with a distressed counterparty before a bankruptcy filing.

Examples of the types of contract modifications or adequate assurances that might be obtained to protect you include modification of credit terms, payments of arrearages, deposits on account, grants of security interests or liens, or obtaining personal or corporate guaranties or letters of credit to enhance the likelihood you receive the performance due to you.

7. Consider Entering into Access and Accommodation Agreements

Sometimes, if you are a customer, you may not have any source other than a financially distressed supplier for certain goods or services that you need. The failure of a sub-supplier to deliver those goods, particularly if you are a supplier in a “just in time” supply environment like the automotive or defense industry, can have disastrous results. Besides costing you lost revenue from the disruption of your business, such a failure may expose your company to large damage claims from your customers who themselves are losing business opportunities. Meanwhile, a financially distressed supplier may be facing threats that its bank or other secured lender will stop lending to it, resulting in its shut down and failure to supply you.

Access and Accommodation Agreements can be used to maintain the flow of goods or services from such a financially distressed supplier while it is being reorganized, sold, or wound down.

- Access Agreement: Permits the customer, under limited circumstances as a last resort, to access the supplier’s plant to produce parts pending rehabilitation of the supplier or transfer of the contract and/or facility to a healthier supplier.

- Accommodation Agreement: Provides customer accommodations that solidify the lenders’ collateral base through protections on inventory and receivables, accelerated payments, and commitments not to take supply opportunities away from the troubled supplier during a designated period absent an event of default. These agreements often provide for waivers of the right of setoff, as well as milestones for a turnaround, sale or wind down process.

8. Withhold/Stop Delivery and/or Reclaim Delivered Goods

Prior to bankruptcy, Section 2-702 of the UCC permits a supplier, under certain circumstances, to withhold deliveries and reclaim (recover) goods delivered if it discovers that the customer is insolvent.10 Reclamation may be subject to rights of a prior lienholder in the inventory or the goods already may have been sold, which limits the effectiveness of a reclamation demand.

Section 2-705 also provides that a supplier “may stop delivery of goods in the possession of a carrier or other bailee when he discovers the buyer to be insolvent …”11

You can use these rights to leverage payments, including cash in advance, recovery of your valuable goods, or changes to your contract that can be favorable to you.

After a bankruptcy is filed, reclamation demands are permitted if submitted early in the proceedings but often have limited effect in bankruptcy.12 In addition, if the Debtor is operating its business and has obtained financing, reclaiming the inventory could affect the Debtor’s ability to reorganize.

9. After Breach Occurs, Issue Notice of Default and Take Other Actions

A breach entitles you to exercise your legal and equitable remedies including bringing claims or filing a lawsuit to collect the amounts owed to you. In such a suit, you may seek recovery of damages you suffer due to the breach, injunctive relief, or specific performance of the contractual obligations.13

The UCC also provides certain express rights to sellers of goods, including but not limited to, suspending your own performance under the breached contract, stopping delivery, re-selling the goods to another buyer or, in appropriate cases, cancelling/terminating the contract prior to a bankruptcy.14 And, depending on the circumstances, buyers have various rights under the UCC for non-performance.15 These include cancelling the contract without further obligations,16 obtaining specific performance, or taking possession of identifiable goods.17 In addition, a buyer can bring claims against a non-performing seller of goods for their damages for breach subject to obligations to “cover” or mitigate their losses.18 Similar rights exist under common law with respect to provision of services rather than goods.

10. Consider Calling an Anticipatory Breach so You Can Exercise the Same Remedies as an Actual Breach

In addition to actual breaches such as non-payment or non-delivery, a party might anticipatorily breach or repudiate the contract if it unequivocally refuses to perform as agreed under the contract. For example, it is not uncommon for financially distressed suppliers or customers to state that they will not perform further unless you as the counterparty agree to some “hostage” type demands such as price increases, further deliveries, or other changes that are not required under your contract. In the event of an anticipatory breach, under the UCC the non-breaching party may await performance for a commercially reasonable time or resort to any remedy for breach even though it has notified the other party that it will await performance.19 The non-breaching party may also suspend its own performance under the contract, which can provide a means to avoid further losses and enhance the likelihood of a financial recovery.

Similar rights may exist under common law with respect to provision of services rather than goods depending on your jurisdiction.

11. Seek Critical Vendor Treatment or Assumption of your Contract

If you are owed amounts for the provision of goods or services by a company that then files a bankruptcy case, you are not necessarily out of luck. Debtors, particularly in the manufacturing industry, often obtain Bankruptcy Court orders authorizing them to pay prepetition debt to “critical vendors” who are essential to their continued operations. Moreover, if a Debtor proposes to assume your contract in its bankruptcy case, you are entitled to a “cure” of any past due amounts owed to you before the debtor is authorized to assume and/or assign the contract. Developing a strategic approach to possible critical vendor treatment or contract assumption (or even new contract negotiation) in advance before a bankruptcy will provide you with the best chance of obtaining these treatments if a bankruptcy case is filed.

Conclusion

A financially distressed supplier or customer can present significant risks for your company and the supply chain generally. The strategies above, used in concert with formulation of an overall plan with bankruptcy and creditors’ rights counsel to increase your leverage and options, can help you achieve the best solutions and results.

Subscribe to the Supply Chain Disruption Series

To help you navigate these uncharted territories in supply chain, we invite you to subscribe to Foley’s Supply Chain Disruption series by clicking here.

1 See 11 U.S.C. §503(b)(9).

2 Most contracts will include provisions that the non-Debtor has the right to terminate its contract upon the filing of a bankruptcy (i.e., ipso facto clauses). For most contracts, these are not enforceable provisions and any attempt to terminate such contracts violates the automatic stay. Exception: If a contract is a safe harbor contract and meets the requirements under sections 559 through 562 of the Bankruptcy Code, these clauses are still operative. This article does not address the special requirements of safe harbor contracts.

3 Generally speaking, an executory contract is a contract with unperformed obligations remaining on both sides, and can include purchase orders if they have such outstanding obligations.

4 Assumption of an executory contract requires all monetary defaults must be promptly “cured” and adequate assurance of future performance must be given.

5 Rejection of a contract constitutes a prepetition breach under the contract. Whatever property rights the non-breaching party would have outside of bankruptcy law, such non-breaching party maintains. See Mission Prod. Holdings, LLC v. Tempnology LLC, 139 S.Ct. 1652, 1658 (2019). However, the counterparty is left with a general unsecured claim for contract rejection damages, which will be paid in bankruptcy dollars, not dollar for dollar.

6 Preferences (possibly including payments received from a Debtor or liens granted by a Debtor within 90 days prior to a bankruptcy filing (1 year for insiders)) might be clawed back if certain requirements are satisfied. Fraudulent transfers, or payments/property received from a Debtor within 2-6 years prior which were received without the Debtor receiving reasonable fair value, while the Debtor was insolvent (or which rendered it insolvent or undercapitalized or unable to pay debts) are also vulnerable to claw back in a bankruptcy.

7 A bankruptcy could cause complications with triangular setoffs. Section 553 of the Bankruptcy Code requires mutuality, and thus triangular offsets and any offsets taken in the lookback periods could be subject to potential avoidance as preferences under Section 553 of the Bankruptcy Code or as fraudulent transfers.

8 Some courts have gone further, restricting the applicability of recoupment to a single transaction, even if the same contract covers multiple transactions. The outcome depends on whether the circuit follows the “logical relationship test” (see Kosadnar v. Metropolitan Life Ins. Co. (In re Kosadnar, 157 F.3d 1011 (5th Cir. 1998) and Newberry Corp. v. Fireman’s Fund Insurance Co., 95 F.3d 1392 (9th Cir. 1996)) or the “integrated transaction test” (see University Medical Ctr. v. Sullivan (In re University Medical Ctr.), 973 F.2d 1065 (3d. Cir. 1992) and Conoco Inc. v. Styler (In re Peterson Distrib., Inc.) 82 F.3d 956, 960-961 (10th Cir. 1996)).

9 Changing credit terms could include: (a) reducing when payment is due (i.e., net 30 to net 10); (b) changing payment methods (from check to ACH/EFT or wire); or (c) reducing the credit limit.

10 Section 2-702 of the UCC provides:

“(1) Where the seller discovers the buyer to be insolvent the seller may refuse delivery except for cash including payment for all goods theretofore delivered under the contract, and stop delivery…“,

“(2) Where the seller discovers that the buyer has received goods on credit while insolvent he may reclaim the goods upon demand made within ten days after the receipt, but if misrepresentation of solvency has been made to the particular seller in writing within three months before delivery the ten day limitation does not apply…”

11 UCC §2-705.

12 As discussed above, a 503(b)(9) Claim would cover the goods received by the Debtor within twenty days prior to the bankruptcy, and would provide a higher priority administrative claim in the bankruptcy.

13 It is common for companies that are distressed to ignore demands unless and until a lawsuit is filed. At the same time, litigation is expensive and there is always a possibility that you will not be able to recover or receive the performance due to you before a bankruptcy is filed or a liquidation occurs.

14 See UCC § 2-703 and § 2-705.

15 See generally UCC §§ 2-711 – 2-716.

16 See UCC § 2-711(1).

17 See UCC § 2-711(2).

18 See UCC § 2-712.

19 See UCC § 2-610.