The United States Seeks Consultations with the Mexican Government Regarding Mexico Energy Policy under the USMCA

The United States of America has requested dispute settlement consultations with the Mexican Government under Chapter 31 of the United States–Mexico–Canada Agreement (USMCA). The consultations are linked to Mexico’s new energy policy implemented by the Mexican President Mr. López Obrador (“AMLO”), specifically regarding legislative and administrative measures adopted in the energy industry during AMLO’s administration. As previously informed, the Mexican government has implemented measures to strengthen Mexico’s state-owned companies mainly in the power and natural gas sector. The main beneficiaries of this new policy include the utility company, Comisión Federal de Electricidad (CFE), and the national oil and gas company Petroleos Mexicanos (Pemex).

Since October 2020, the U.S. Government and Congress have repeatedly expressed concerns regarding the changes in the energy policy implemented by AMLO’s administration and the negative impacts on US investors, which violate the provisions of the USMCA. John Kerry, the United States special presidential envoy for climate, has visited Mexico three times in the last eight months to discuss the new energy policy and energy transition in Mexico with the Mexican President. However, no changes have been implemented, despite Kerry’s endeavors and efforts from numerous congressional representatives expressing their concerns to the current and former U.S. presidents.

The request for consultations covers four main topics reasoning that Mexico’s new energy policy and measures are inconsistent with the USMCA, specifically provisions regarding Market Access, Investment, State-Owned Enterprises, Publication, and Administration.

1. Amendments to the Electricity Industry Law

In 2019 the Mexican Congress passed certain amendments to the Electricity Industry Law (“EIL”). One of the main changes to the EIL consisted in the change of the dispatch rules for the National Electric System. According to the amendments to the EIL, Mexico’s independent system operator (CENACE) is now forced to prioritize electricity coming from power stations owned by CFE over electricity generated from power stations owned by the private investors, regardless if they are more clean and cost efficient. These measures prevent the private investors access to the power market and favors CFE over other players in the power market.

2. Regulatory Impasse

The U.S. Government also considers that the private companies are hindered to operate in the energy sector in Mexico by delaying, denying or revoking power generation permits or any modification thereof. These measures have prevented private investors to (i) operate renewable power generation facilities; (ii) import and export fuel; (iii) operate fuel storage facilities or (iv) build and operate retail fuel stations.

3. Delay in the Requirement to Supply Ultra-Low Sulfur Diesel only for Pemex

In 2019, the Energy Regulatory Commission (“ERC”) granted, only and exclusively to Pemex, a five year extension to the obligation on maximum sulfur content requirement for automotive diesel standard.

4. Natural Gas Transportation Policy

On June 13, 2022 the Ministry of Energy (ME) sent to the ERC and the Independent Natural Gas System Operator (CENAGAS) an official communication exhorting the ERC to modify the independent system operator’s general terms and conditions applicable to the national integrated pipeline system (SISTRANGAS) in order to force the SISTRANGAS’ users to buy natural gas from CFE or PEMEX in the natural gas market.

5. State vs State Dispute Mechanism under the USMCA

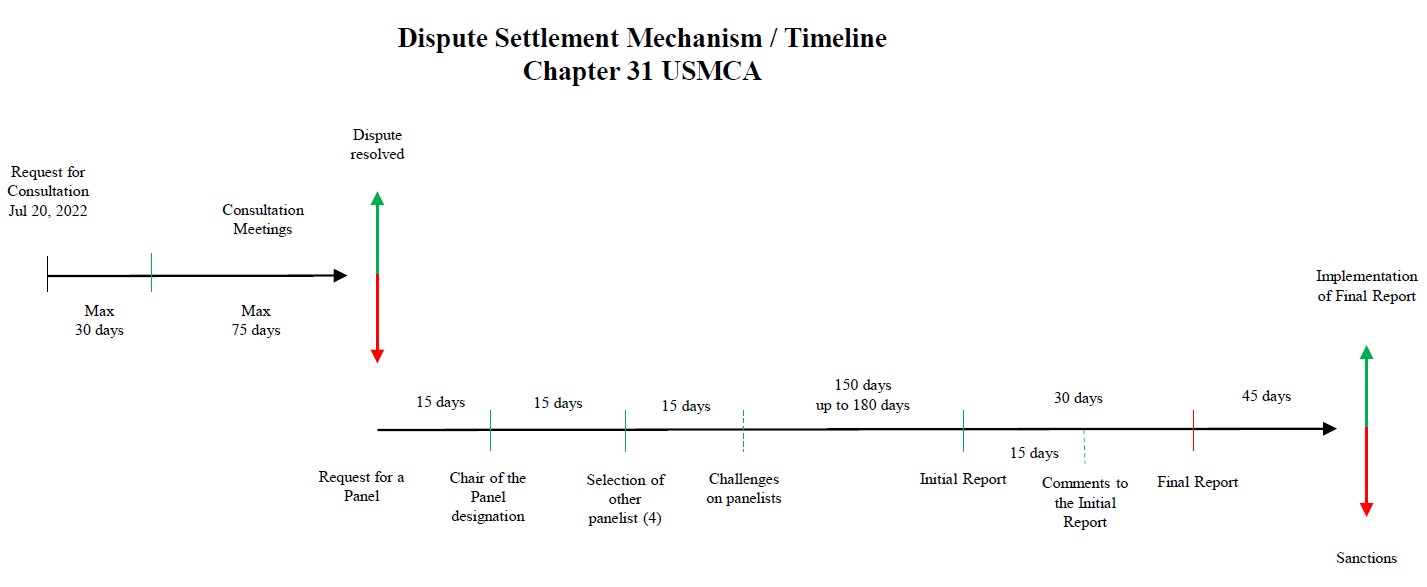

Pursuant to Chapter 31 of the USMCA, the parties shall enter into consultation procedure 30 days after the delivery of the request. The consultation procedure shall be confidential. If the Parties fail to resolve the dispute within 75 days after the request of consultation, the U.S. Government may request the establishment of a panel. The panel shall present the final report on the dispute approximately 200 days as of the request was made.

If the U.S. Government prevails in the dispute, the Mexican Government will be forced to derogate the amendments passed by the Congress to the Electricity Industry Law, forcing the ERC to respect the current Energy Reform. Otherwise, the U.S. Government may suspend the application to Mexico of benefits of equivalent effect to the non-conformity or the nullification or impairment until the Parties agree on a resolution to the dispute.

6. Investment Arbitration for Private Investors

Regardless of the Consultation procedure initiated by the U.S. Government, this is a State vs. State dispute. The Consultation procedure will neither hinder nor prevent the private investors to initiate investment arbitration against the Mexican government as a result of AMLO’s new energy policy. As you may recall, private investors holding power generation permits, retail fuel station permits, and/or fuel import/export permits are protected by the USMCA/NAFTA or the CPTPP and thus, are entitled to file for investment arbitration against the Mexican government.

Foley & Lardner LLP has created a multidisciplinary and multijurisdictional team to respond and assist our clients in any potential investment arbitration procedure regulated under international trade agreements. For more information, please contact our team.