Navigating the Road Ahead: How AI and Vehicle Automation are Transforming the Transportation Industry

Artificial Intelligence (AI) is expected to impact almost every modern industry, with no exception for the automotive and transportation industries. Today’s cars are more “connected” than ever, offering features such as real-time traffic updates, vehicle-to-vehicle (V2V) and vehicle-to-everything (V2X) communication, predictive maintenance reminders, and advanced driver assistance system (ADAS) features like lane-keep assist and automated emergency braking. With a seemingly unrelenting focus across all industries to become AI leaders, it’s only a matter of time until the 20th century’s fanciful notion of full vehicle automation becomes a 21st century reality.

Despite these advances, a new array of challenges are emerging that have the potential to apply the brakes to the industries’ impressive technical progress. Legal, regulatory, and public perception remain unknown variables that may delay or halt the industries’ plans to deploy these new technologies at scale. Non-practicing entities are beginning to target manufacturers, asserting patents that target these companies’ ADAS offerings. Cybersecurity threats are presenting new concerns about the potential effects of malicious actors on vehicles that are increasingly less reliant on humans for operation. Further, well established norms around risk and accountability in the insurance industry and the traditional blue-collar workforce are increasingly becoming obsolete as the shift toward AI-driven vehicles continues.

In this article, we discuss these shifts, focusing on the contemporary impacts of AI and vehicle automation on the automotive and transportation industry.

Legal, Regulatory, and Public Perception of AI and Autonomous Vehicles

Current regulatory hurdles may not present long-term roadblocks as the technology matures and is increasingly adopted. Currently, there is no comprehensive federal legislation or regulations in the U.S. that regulate the development of AI or that specifically prohibit or restrict its use with autonomous vehicles. The Autonomous Vehicle Industry Association and the Alliance for Automotive Innovation have advocated for federal regulation of autonomous vehicles (AVs) through the National Highway Traffic Safety Administration (NHTSA). However, each have acknowledged that federal law should not prevent AV advancement. Rather, the legislation would provide a framework for AV developers and traditional vehicle manufacturers to deploy and commercialize this technology.[1] Notably, NHTSA does not preapprove or prohibit companies from introducing new vehicles or technology so long as they comply with motor vehicle safety standards. Vehicles that do not comply can still be deployed but must apply for an exemption first. NHTSA allows up to 2,500 exemptions per company annually to allow for vehicle development or field evaluation.[2]

On May 3, 2024, the U.S. Department of Transportation’s (USDOT) Advanced Research Projects Agency–Infrastructure (ARPA-I) released a request for information (RFI) on “Opportunities and Challenges of Artificial Intelligence (AI) in Transportation.” This follows Executive Order (E.O.) 14110 issued on October 30, 2023, which calls for the safe and responsible development and use of AI in transportation, with ARPA-I investigating AI’s impact on autonomous mobility ecosystems.

State legislatures have taken a different approach. In 2024, New York introduced legislation that would require drivers to be present in certain AVs based on weight range.[3] California recently passed a bill that prohibits the operation of any AV weighing more than 10,001 pounds on public roads for testing, transporting goods, or transporting passengers without ahuman operator physically present when operating.[4] California proposed legislation that would apply the same prohibition against the testing and deployment of light-duty AVs weighing less than 10,001 pounds. California also passed A.B. 3061, which would require AV companies in California to publicly report to the state DMV all collisions, disengagements, immobilizations, or certain traffic violations involving their vehicles. Municipalities are also pushing back against AVs. San Francisco City Attorney David Chiu sued the California Public Utilities Commission (CPUC) for its decision to allow the expansion of AV services across the city without limitations.

Despite the status of proposed legislation and uncertainties in AI regulation, the large-scale adoption of AVs will depend on the public perception. Critics point to high-profile incidents when asserting that AV and ADAS are not ready for wide-scale deployment.

Recent Litigation Trends in the Automotive Industry Involving AI

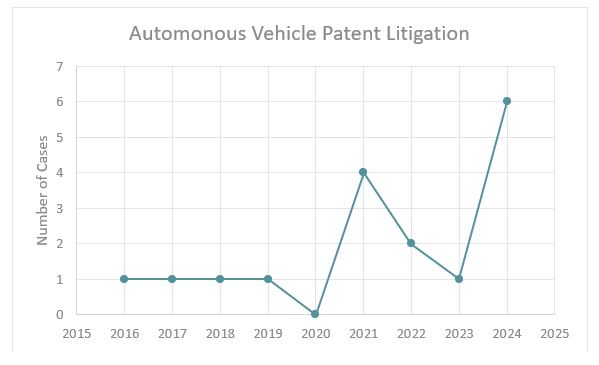

Underscoring the ongoing tensions in the rapidly evolving world of self-driving technology employing AI, in recent years, high-profile patent-infringement lawsuits have been initiated against major players in the field. Since 2020, there has been a general increase in the amount of patent litigation for patented AV technology, including features with AI[5]:

The increase in AV litigation since 2020 highlights the increasingly complex landscape of patent litigation in the AV sector. However, it is unclear how AV litigation may continue to scale as the technology expands nationwide. Stakeholders will need to closely monitor these developments, and developments relating to recent antitrust cases in Big Tech, to be best prepared to navigate the evolving legal terrain effectively.

Cybersecurity and Data Privacy in Connected Vehicles

As vehicles become “smarter” and incorporate more advanced AI and driving automation features, they also increase their exposure to cyberattacks. According to a 2023 report by Upstream,[6] automotive cyberattacks spiked by 380% in just one year, from 2021 to 2022. This happened despite OEMs employing similarly advanced cybersecurity protections for these systems. The attacks spanned several critical systems, including telematics, infotainment systems, electronic control units, and remote keyless entry systems. And as driving tasks continue to be automated, it’s only a matter of time until more advanced, safety-critical systems are targeted.

One reason for this spike is the increase in access points offered (or required) to implement these advanced features. As would be expected, highly complex computing systems need to be installed to allow for improved user experiences and driving automation. But as the number of computing devices, sensors, and other various components increases, so does the attack surface available to malicious actors. For example, Upstream reports that 4% of the cyberattacks stemmed from vehicle-to-infrastructure (V2I) communication relating to charging infrastructure.[7] Similarly, when a driver or passenger connects their phone to a vehicle, that connection may expose the user’s personal information stored on their device. And with each new sensor and communication interface added to allow for vehicle automation, this attack surface grows.

Regulations by governmental entities are expanding to address these issues and risks, by providing best practices guidance or requiring vehicle manufacturers to demonstrate that their cyber security management system adequately mitigate cyber threats and vulnerabilities within a reasonable timeframe.[8] These measures aim to shore up vulnerabilities and drive the industry forward by further developing intelligent vehicles. Those OEMs that take it a step further by investing in additional layers of protection (such as machine learning-based threat detection, real-time data encryption, and multi-layered firewalls) can help secure vehicle networks and protect consumer data while we move further into the 21st century.

Changing the Insurance Mindset with Automated Vehicles

Introducing more automated vehicle features (including advanced driver-assist features and high-automation systems (often referred to today as AVs)) to our roadways creates a new slate of issues for insurance companies to consider when underwriting policies. If an automated vehicle’s driving system is engaged during a collision, or an AV crashes, who is at fault? The human “driver”? The vehicle manufacturers? And what role do software developers or suppliers play who offer systems to OEMs for integration? While it seems like these open-ended questions only grow in number one thing is clear: the insurance industry’s approach needs to adapt quickly.

Today’s automated vehicles and AVs incorporate far more sophisticated technology than what was available even a few years ago, which will require specially trained mechanics and equipment, greatly increasing the cost of repairing vehicles damaged in accidents. For example, where a collision a few years ago may have affected parking sensors or advanced headlights or indicators, automated vehicles and AVs include multiple, highly sophisticated sensors such as radar sensors, carefully calibrated cameras, and in some cases LiDAR sensors. This likely will drive up coverage rates and deductibles, at least in the short term.

But it’s unclear whether, and to what degree, these automated technologies will reduce the rates of accidents and whether fewer overall claims will result in lower costs when insuring these vehicles. For example, people generally expect that the proliferation of automated vehicles will drastically reduce accident rates, resulting in a corresponding decline in premiums, with some analysts even predicting a drop in premiums by up to 60 percent by 2035. However, insurance companies continue to struggle with providing the predictive data about frequency of AV accidents as their technology is continuously evolving. To moderate this uncertainty, insurance technology (insurtech) companies are beginning to develop with a mandate to revamp older risk models by using new forms of AI-based risk modeling.

Impact of AI on the Workforce

The expansion of AI is reshaping how vehicles are engineered, built, tested, serviced, and deployed. AI’s integration into automotive manufacturing is transforming the workforce, bringing both opportunities and challenges. McKinsey & Company projects that AI could boost automotive productivity by approximately 1.3% each year, achieved through process optimization across the manufacturing and testing processes.[9] In a separate report, McKinsey & Company reported that 70% of companies are integrating generative AI into research and development, with most being in the pilot stage and prioritizing future deployments. [10] Some of these use cases and pilots include engineering, software testing and validation, and product design and optimization.

However, this increased reliance on AI has raised concerns about the displacement of workers. The International Federation of Robotics reports that industrial robot installations have grown year-over-year, led largely by the automotive industry.[11] Of the 500,000+ installations across all sectors, the automotive industry contributed to 25% of those installations, growing both in the OEM and supplier segments. While robotics enhance productivity, they also reduce the need for certain manual labor roles, particularly in repetitive tasks that AI systems and robotics can handle with greater precision and speed. Despite fears of job losses, AI presents an opportunity for workforce evolution. According to the World Economic Forum in 2020,[12] while automation may displace 85 million jobs through 2025, 97 million new, automation-related jobs are expected to be created globally. Much of these projected jobs relate to tasks better suited for human interaction, including managing, advising, decision-making, reasoning, communication, as well as management of AI systems, including engineering, cloud computing, and product development.

Major automakers are also investing in retraining and upskilling initiatives to transition employees from traditional manufacturing roles to more technology-centric positions. These initiatives help mitigate job displacement risks while also enabling employees to cooperate with their AI counterparts as the market shifts.

As the automotive industry continues to embrace AI, companies that proactively invest in employee development and AI-driven technologies will likely lead the way, securing both economic growth and a skilled, future-proofed workforce.

Conclusion

Artificial intelligence is undeniably reshaping the automotive industry, from autonomous driving and AI-driven manufacturing to the creation of new roles and responsibilities in research, development, and system management. While these advancements are transformative, they also bring challenges which are to be addressed by key stakeholders across the automotive sector and government. As AI takes the wheel, companies that proactively navigate these complexities, while also investing in both technology and the workforce, are poised to lead the industry into a new era.

Subscribe to the 2024 Auto Trends Series

For a recap of the past year’s developments and discussion of ongoing trends, we invite you to subscribe to this 2024 Auto Trends Series by clicking here.

[1] Federal Policy Framework for our AV Future, March 2023, by Autonomous Vehicle Industry Association, https://theavindustry.org/resources/AVIA-Federal-Policy-Framework-for-Our-AV-Future.pdf.

[2] https://www.nhtsa.gov/sites/nhtsa.gov/files/documents/understanding_nhtsas_current_regulatory_tools-tag.pdf

[3] S.7758 still in committee.

[5] Chart data for patent litigation relating to autonomous vehicle technology derived from Lex Machina.

[6] “2023 Global Automotive Cybersecurity Report,” Upstream, p. 19.

[7] Id., pp. 7, 18, 40.

[8] Federal Register, Vol. 87, No. 174, pp. 55459-65, “Cybersecurity Best Practices for the Safety of Modern Vehicles,” September 9, 2022; Addendum 154 to UN Regulation No. 155, “Uniform Provisions Concerning the Approval of Vehicles with regards to Cyber Security and Cyber Security Management System,” January 22, 2021.

[9] “Artificial Intelligence – Automotive’s New Value-Creating Engine,” McKinsey Center for Future Mobility, January 2018.

[10] “Automotive R&D Transformation: Optimizing Gen AI’s Potential Value,” McKinsey & Company, February 9, 2024.

[11] “Executive Summary World Robotics 2023 Industrial Robotics,” International Federation of Robotics, available at https://ifr.org/img/worldrobotics/Executive_Summary_WR_Industrial_Robots_2023.pdf

[12] “Recession and Automation Changes Our Future of Work, But There are Jobs Coming, Report Says,” World Economic Forum, October 20, 2020, available at https://www.weforum.org/press/2020/10/recession-and-automation-changes-our-future-of-work-but-there-are-jobs-coming-report-says-52c5162fce/