Harper Brown is a litigation attorney who advises and represents clients in a wide range of disputes, including fiduciary litigation, securities litigation, government investigations, and contract and warranty disputes. Her experience includes representing clients through all stages of litigation in both state and federal courts — from filing the complaint through trial. Harper also has experience counseling clients through government inquiries from a variety of federal and state agencies.

Prior to joining Foley, Harper was a legal intern for several government agencies and a global manufacturing company.

Awards and Recognition

- Gwynette E. Smalley Law Review Prize (2021)

Delaware Enacts Significant Changes to Delaware General Corporation Law

As discussed in Foley’s Corporate Governance Update last month, SB 21: Delaware Responds In The DExit Battle, the Delaware legislature has been moving quickly to ensure that Delaware remains the preeminent home of choice for many corporations by amending the DGCL.

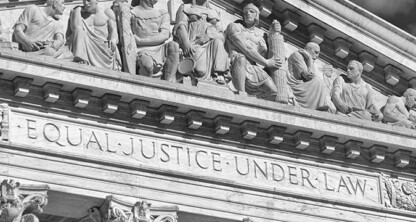

The End of Chevron Deference and the Implications for the SEC

On June 28, 2024, the U.S. Supreme Court issued its decision in Loper Bright Enterprises v. Raimondo and Relentless Inc. v. Department of Commerce, overruling the Chevron doctrine.

Significant Recent Decisions Relevant To Private Company M&A

In navigating the complex world of private company mergers and acquisitions (M&A), understanding recent legal decisions is paramount.

Foley Wins Dismissal for City of Milwaukee in FCA Suit

Foley & Lardner LLP represented the City of Milwaukee in winning dismissal of a False Claims Act suit in which a pair of relators alleged that the city, county, and housing authority of Milwaukee falsely certified compliance with anti-discrimination and housing laws to receive government funding.

Foley Wins Motion to Dismiss for City of Milwaukee in FCA Suit

Foley & Lardner LLP represented the City of Milwaukee in prevailing in a motion to dismiss a False Claims Act suit.

Can Directors/Officers be Liable for Depositing Corporate Funds in and Borrowing from a Bank Taken Over by the FDIC?

While the FDIC and the Treasury Department have since stepped in to ensure that all deposits are protected, the Silicon Valley Bank collapse is an opportunity for corporate directors and officers to reassess their current risks relating to cash management and investment policies in the current environment of economic uncertainty.