Table of Contents

|

Executive Summary

At the end of March – amid the first wave of COVID-19-related shutdown orders – an esports record was broken when 1.3 million broadcast television viewers tuned in to watch professional NASCAR drivers compete in a virtual race on FOX and FS1.

To the broader market, it was a clear signal that life under the coronavirus might be accelerating the industry’s expansion. Earlier that month, Verizon observed a 75% increase in video game internet traffic during peak hours and, in the second quarter, when live traditional sports were in lockdown, Twitch reported a 56% viewership rise year-over-year.

As the pandemic wears on, the 3rd Annual Esports Survey, conducted by Foley & Lardner LLP and The Esports Observer, draws on responses from hundreds of executives to explore perceptions on the current state of esports and what lies ahead at a crucial moment in its evolution.

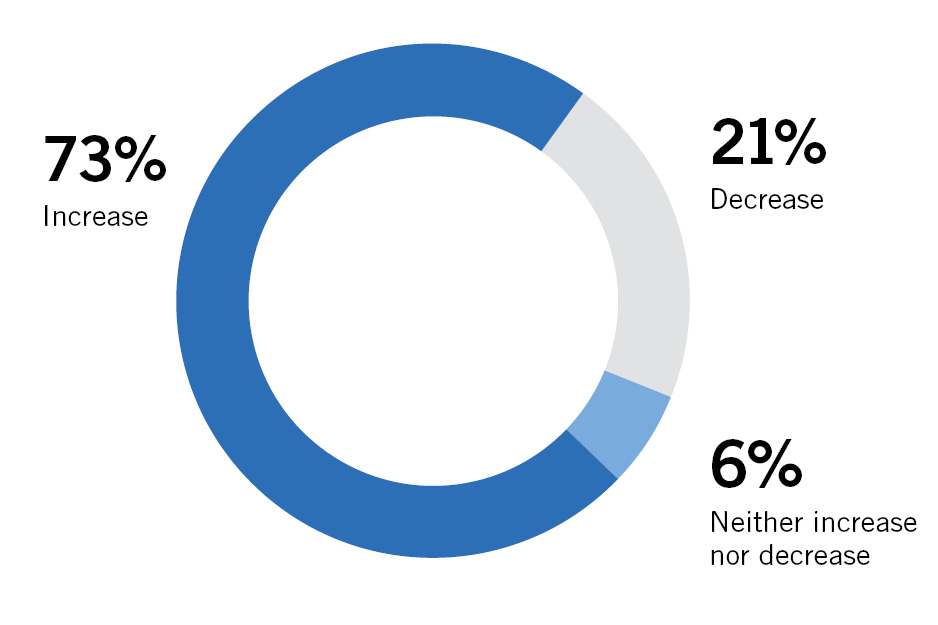

Though still a young and growing industry – and one dwarfed by the $159 billion video gaming industry within which it sits – esports is expected to generate revenues of $950.3 million globally in 2020. While this may be less than the industry’s pre-pandemic forecast, it represents only a 1% decline from 2019, underscoring the strength of esports even in the face of widespread economic turmoil. In fact, the majority of our survey respondents (73%) expect the pandemic to generate greater investment and deal activity in esports in the near-term.

|

|

|

But while the industry has managed to thrive in a year that has wrought havoc in so many other areas, even esports isn’t immune to the impact of COVID-19. This year’s survey saw a decrease in the level of esports investment expected from private equity and venture capital firms (40% expect increased investment from this group, down from 47% in 2019). And the inability to hold live large-scale events was the top factor cited among respondents who expect decreased investment in esports in the near-term.

The pandemic and related economic issues aren’t the only areas affecting the industry’s evolution. Take gambling, for example. Even amid the pandemic, legalized sports (including esports) betting in the United States has brought certain states sorely needed revenue. With more and more dollars on the line, however, survey respondents expressed concerns about high-profile match-fixing cases and a lack of adequate tools to detect fraud and cheating.

Legal risks also abound, with cybersecurity, intellectual property, licensing, and labor and employment matters among the top areas of concern identified in the survey. The latter has become increasingly prevalent of late, as popular players dispute contract terms with esports teams, organizations, and streaming platforms, and as #MeToo continues to send wake-up calls throughout the male-dominated industry.

Finally, this year’s survey suggests heightened tension around the small number of game developers who exert significant control over the industry. At the same time, respondents are more conflicted than ever when it comes to the need for, or practicality of, a single, overarching esports governing body – suggesting, perhaps, that as the industry grows, it’s also fragmenting and developing increasingly complex and varied business models.

Looking at the prior three years of survey data at a high level, it’s clear that executives involved in esports are becoming increasingly comfortable that the industry is on a strong footing, as well as more sophisticated about navigating the obstacles facing esports. While there are still challenges ahead, respondents are optimistic that COVID-19 has not derailed – and may actually accelerate – the industry’s growth prospects.

| GROWTH AND INVESTMENT | |||||

|

COVID-19 has been a boon for esports – but it’s not all smooth sailing |

|||||

Nearly three-quarters of respondents (73%) believe the pandemic will lead to more investment and deal activity over the next six months (Q4 2020 and Q1 2021).

More than half cite the drivers of this trend as being continued social distancing boosting engagement with video games and esports (61%), the growth of online streaming platforms (61%), and the increased movement of big brands into esports sponsorships (52%).

This type of bullish sentiment may be expected for an industry that was already largely virtual. But responses from the 21% of respondents who believe investment in esports will decrease over this six-month period as a result of COVID-19 illustrate that the industry is not immune to the pandemic.

For instance, a significant number of respondents in this group cited challenges stemming from the inability to hold large in-person events (77%), continued declines in spending on advertising and sponsorships (65%), and a hesitancy to invest in esports teams due to continued esports market uncertainty (46%). The latter factor coincides with the 31% who also noted the difficulty of sourcing capital beyond internal raises with existing investors.

Meanwhile, frozen marketing budgets may contribute to the fact that while advertising and sponsorships ranked as the top area expected to drive revenue growth for the third straight year, the percentage of respondents selecting it as the most promising area actually decreased from 51% in 2019 to 41%. On the bright side, most respondents expect new technology developments will lead to more sophisticated advertising in esports over the next year, be it enhanced data analytics (67%), integration of ads within games and streaming platforms (64%), or advanced behavioral analytics that enable advertisers to better target their ads (63%).

In-game purchases and revenue once again took the second-ranked spot among areas expected to drive revenue growth, followed by media rights.

| RESPONDENTS CITED CHALLENGES STEMMING FROM THE INABILTY TO HOLD LARGE IN-PERSON EVENTS | HOW WILL THE PANDEMIC IMPACT ESPORTS INVESTMENT AND DEAL ACTIVITY IN Q42020 AND Q1 2021? |

|

|

| “Hardly any industry was spared from COVID-19’s economic impacts, but esports has been better positioned than most to leverage pandemic-induced lockdowns. Investors remain interested in the value and potential of esports, and the fact that its massive audience has accelerated its growth in these uncertain times has created more intrigue. The next step will be to derive more revenue from that audience, as it remains under-monetized relative to traditional sports, media, and entertainment properties.” | |

| Bobby Sharma | Special Adviser to the Sports & Entertainment Group | Foley & Lardner LLP | |

As for esports investment – and who is doing the investing – the results suggest there may be some reluctance from investors hit hard by the downturn to inject further capital into still uncertain business models. Nearly half of respondents (49%) expect traditional professional sports teams, leagues, athletes, and celebrities to increase their investment in esports over the next year, up slightly from 47% last year (but down from 57% in 2018). The percentage who expect increased investment from private equity and venture capital firms actually fell from 47% in 2019 to 40% this year, and the level of investment by other groups also saw slight decreases from 2019.

EXPECTATIONS OF INCREASED INVESTMENT IN ESPORTS OVER THE NEXT YEAR AMONG KEY INVESTOR GROUPS SEES SOME DECLINE

| 57% | ||||||||||

| 49% | ||||||||||

| 47% | 47% | |||||||||

| 39% | 40% | |||||||||

| Traditional professional sports teams and leagues, athletes and celebrities | Private equity and venture capital firms | |||||||||

| 2018 | 2019 | 2020 |

None of that is surprising amid a recession and a global pandemic, even if esports has some advantages in a world where so much is now remote and virtual. Yet it begs the question: How long will it take for investment and deal activity to return to pre-COVID-19 levels? While the survey findings, taken together, suggest a positive long-term outlook for esports’ continued growth, some perceive the next year or two as something of an uphill battle. For instance, among the small group of respondents who do not expect an increase in esports investment over the next six months, 60% believe it will take at least a year for activity to return to pre-pandemic levels.

| “While revenues from advertising and sponsorships remain the most significant source of income for players within the core competitive esports ecosystem, in-game purchases have become an increasingly important revenue driver for the general gaming industry, particularly in an era of social distancing. The growth of media rights, on the other hand, has stagnated a bit as streaming platforms’ bidding for exclusive media rights to esports leagues and tournaments slowed down — at least in the Twitch-dominated U.S. and European markets.” | |

| Tobias Seck | Business Analyst | The Esports Observer | |

Traditional sports needs a digital makeover in the COVID-19 era. Can esports pave the way?

The pandemic has shined a light on the numerous ways in which the business models of esports and traditional professional sports both overlap and diverge.

While traditional professional sports were certainly hit harder by the absence of live events, the impact was also felt by the esports industry, which relies heavily on events – not only for ticket revenue and merchandise sales, but as the primary manifestation of its culture.

The two industries are also in increased competition for the coveted millennial audience. While the audience for traditional professional sports is aging, research shows that esports is attracting younger viewers. For instance, 75% of the U.S. esports audience is between the ages of 18 and 34, according to Nielsen Esports Fan Insights.

Recognizing that younger audiences are consuming content in different ways, traditional professional sports organizations are increasingly looking to esports for new ways to leverage technology and engage with fans – whether it’s NASCAR’s iRacing series, Major League Soccer’s eMLS league, or broadcasting simulations of previously scheduled NBA and NHL games.

Our survey responses support this trend. When asked how traditional professional sports might focus on digital technologies amid the rise of esports and the ongoing pandemic, only 2% of respondents did not believe there will be lasting impacts. The top choices are listed on the right.

| GAMBLING AND MATCH-FIXING | |||||

|

Esports gambling represents a huge new revenue stream. |

|||||

Can the industry realize it? With almost no traditional professional sports to gamble on, the early months of the pandemic saw a rapid spike in both the approval of esports for the first time by major betting regulators and, of course, the subsequent placing of legal bets – thereby opening another potential revenue channel for the industry.

The potential for regulated esports gambling is high. In 2016 alone, there was $5 billion gambled (illegally) on skins for one game, Counter-Strike: Global Offensive. As initial regulatory approvals were made earlier this year, the ceiling for such revenue has only gotten higher. In mid-March, the esports betting site Luckbox reported a 54% increase in new player registrations and, over the next month, the Nevada Gaming Control Board granted approval for sportsbooks to take legal wagers on matches for ESL Pro League, Call of Duty League, and several other major esports properties. By September, DraftKings CEO Jason Robins was on Bloomberg TV saying that “Esports has been huge for DraftKings.”

In our survey, 51% of respondents agree that the esports industry seized the opportunity to grow its gambling footprint while traditional professional sports were shut down; 22% disagreed, while 27% neither agreed nor disagreed. Part of this may be a result of state lawmakers legalizing sports betting as a revenue source amid rampant budget shortfalls. However, there remains some skepticism from regulators and bookmakers about the risks involved in taking bets on esports events – a sentiment which came through in our survey.

For instance, when asked what poses the greatest threat to the esports betting market, the top choice was a lack of adequate detection systems and monitoring tools for fraud and cheating (46%). Addressing such concerns may explain the timing behind Activision Blizzard’s deal with Sportradar to institute a comprehensive integrity program for their Overwatch and Call of Duty leagues, similar to deals in recent years by major traditional sports leagues. Other concerns regarding esports betting include the general public’s lack of esports knowledge when betting (45%), fears of match-fixing (37%), and the lack of oversight on esports by an overarching governing body (31%).

In addition, 75% of respondents agree (and 39% of those respondents strongly agree) that match-fixing and cheating pose a significant threat to the legitimacy and growth of esports – a considerable jump from 2019, when only 29% strongly agreed this was the case. Recent scandals out of China involving the Rogue Warriors and former Dota 2 champions Newbee may be top of mind for many respondents. And some commentators have posited that tournament delays and other economic hardships these past few months might be motivating these scandals.

EXECUTIVES FEEL MORE STRONGLY THAT MATCH-FIXING AND CHEATING POST A SIGNIFICANT THREAT TO ESPORTS

| 39% | 39% | |||||||||

| 36% | ||||||||||

| 29% | ||||||||||

| Strongly Agree | Agree |

|||||||||

| 2019 | 2020 |

| LEGAL RISKS | |||||

|

Cyber, IP, |

|||||

As the esports industry changes, so too does the nature of the legal risks it faces.

| “It’s understandable that – while still topping the list of risks – IP and cybersecurity issues have declined a bit in importance as technology improves and the esports industry becomes more adept at protecting its IP and consumer data. In the meantime, as an industry so centered on its players, esports continues to grapple with myriad labor and employment concerns, including how talent is engaged contractually and the scourge of unacceptable behavior that brings #MeToo and other allegations of discrimination. Industry stakeholders will need to address these issues with greater sophistication for esports to move further into the commercial mainstream.” | |

| Jon Israel | Co-chair of the Sports & Entertainment Group | Foley & Lardner LLP | |

Though respondents still view intellectual property/licensing and cybersecurity issues as posing the most risk to the esports industry – they were selected by 48% and 41% of respondents, respectively – both areas dropped by roughly 10 percentage points since 2019. Other areas have gone up, such as cyberbullying within games (40% in 2020 from 32% in 2019) and labor and employment issues (38% in 2020 from 31% in 2019).

| IP Rights and licensing issues |

50% | ||||||||

| 61% | |||||||||

| 48% |

| Cybersecurity and malware attacks |

65% | ||||||||

| 50% | |||||||||

| 41% |

|

Cyberbullying |

43% | ||||||||

| 32% | |||||||||

| 40% |

| Labor and employment issues |

28% | ||||||||

| 31% | |||||||||

| 38% |

| 2018 | 2019 | 2020 |

The increased concern regarding labor and employment issues may in part be driven by lawsuits like Tfue’s dispute with FaZe Clan, in which he alleged the company deprived him of business opportunities and failed to pay his share of sponsorship revenues.

It follows that when asked which areas are important players’ rights/employment law issues facing esports, a significant number of respondents chose providing proper employee benefits (53%), contract disputes/renegotiation as players increasingly assert their rights (47%), classification of workers as independent contractors vs. employees (44%), and violations of discrimination and harassment laws (35%). The top response – at 68% – was the management of players under the age of 18, which is not surprising given the industry’s demographic makeup.

In recent months, the industry also saw numerous allegations of sexual assault, harassment, racism, and discriminatory conduct against popular gamers and high-level gaming executives. These issues stem from sexism endemic to an industry that, according to Wired, has been “steeped in the trappings of traditional masculinity for decades.”

| MOST AGREE THAT THE CONTROL EXERTED BY A SMALL NUMBER OF GAME DEVELOPERS IS PROBLEMATIC |

|

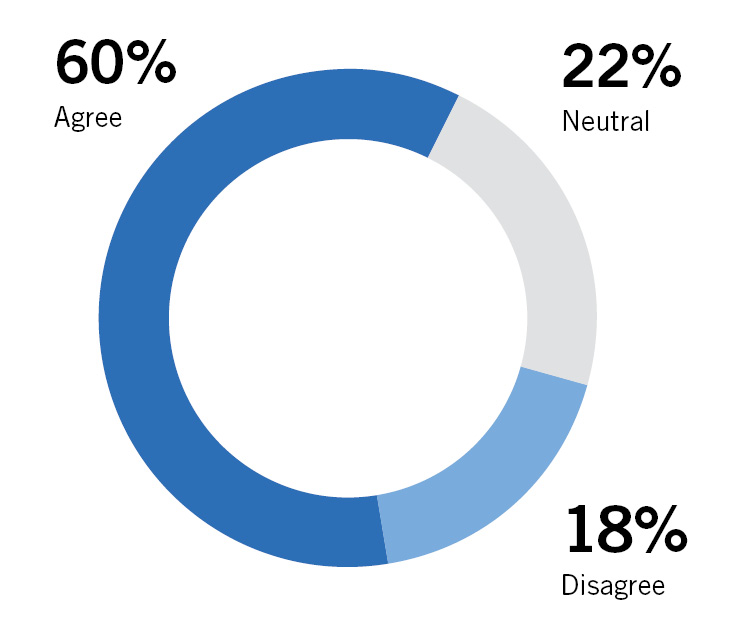

Other challenges include the control a small number of game developers exert over esports, which most survey respondents (60%) agreed is a barrier to the industry’s growth and development (only 18% did not perceive this as a problem). While game developers exerting their IP rights has not been a major threat to the industry to date, it remains an issue looming in the background that executives are keeping an eye on as the esports ecosystem continues to evolve and expand.

Finally, as the esports industry matures, there has been much talk about whether a single, overarching governing body is needed to regulate the industry and set uniform rules. According to our survey results, this idea may be less viable as esports gets bigger and more complex: less than half (45%) agree the industry now needs it, and the percentage of respondents who strongly disagree shot up from 13% in 2018 to 26% this year.

| “As various stakeholders in the esports industry become more concerned with protecting their personal brands, trademark-related issues are moving more to the fore. While it has been less common in esports for teams to seek registered trademark protection, the industry has recently become savvier about registering trademarks and protecting their growing enterprises. Given the complexity of the esports ecosystem, along with the unique dynamic created by publishers owning the IP for games, it’s no surprise that IP issues remain high on the radar of survey respondents.” | |

| Julie McGinnis | Member of the IP Practice and Sports & Entertainment Group | Foley & Lardner LLP | |